Creating a robust business loan repayment schedule is crucial for the financial health of your company. Proper planning ensures timely payments, avoids late fees and penalties, and ultimately contributes to a strong credit history. This comprehensive guide will walk you through the essential steps of building a personalized repayment schedule, covering everything from calculating your monthly payment to incorporating interest rates and principal amounts. Learn how to effectively manage your business loan and avoid potential financial pitfalls with our easy-to-follow instructions.

Understanding how to structure a repayment plan for your small business loan or commercial loan is vital for budgeting and long-term financial stability. We will detail different repayment methods, explain the importance of understanding your loan terms, and offer practical tips for staying on track. By the end of this article, you’ll be equipped to create a repayment schedule that aligns perfectly with your cash flow and contributes to your business’s overall success. Mastering your loan repayment process empowers you to focus on growth and profitability.

Why a Repayment Schedule Matters

A well-structured repayment schedule is crucial for the financial health of your business. It provides a clear roadmap for managing your loan obligations, ensuring timely payments and avoiding potential penalties or defaults. Without a schedule, you risk losing track of payment due dates, potentially damaging your credit score and business reputation.

More than just a list of payments, a repayment schedule acts as a powerful financial planning tool. It allows you to accurately forecast your cash flow, ensuring you have sufficient funds available to meet each payment obligation. This proactive approach helps avoid unexpected financial strain and prevents disruption to your business operations.

Furthermore, a detailed repayment schedule serves as a valuable communication tool. It can be shared with lenders and investors, demonstrating your commitment to responsible financial management and providing transparency into your debt repayment strategy. This fosters trust and strengthens your business relationships.

Finally, a repayment schedule contributes to improved financial discipline. By clearly outlining your payment obligations, you are better equipped to budget effectively and prioritize debt repayment within your overall financial strategy. This ultimately leads to stronger financial management practices and increased chances of long-term business success.

Understanding Term Loans vs Revolving Credit

Before creating a business loan repayment schedule, it’s crucial to understand the fundamental differences between the two primary types of business loans: term loans and revolving credit. Each has distinct characteristics that significantly impact repayment strategies.

A term loan provides a fixed amount of money upfront, disbursed in a lump sum. This amount is repaid over a predetermined period, typically with regular, fixed payments (principal and interest) at scheduled intervals. The interest rate is usually fixed, offering predictable monthly payments. Term loans are ideal for large, one-time purchases like equipment or real estate, where a specific, known amount of funding is needed.

In contrast, revolving credit functions more like a credit card for businesses. It offers a pre-approved credit limit from which you can borrow and repay funds multiple times throughout the credit’s duration. You only pay interest on the outstanding balance, allowing for flexibility in borrowing and repayment. Revolving credit is beneficial for managing fluctuating operational expenses, where the funding needs might vary throughout the year.

The choice between a term loan and revolving credit depends heavily on your business’s specific needs and financial situation. Consider factors like the amount of funding required, the purpose of the loan, and your business’s ability to handle fixed versus variable payments. Understanding these differences is key to developing an effective and manageable repayment schedule.

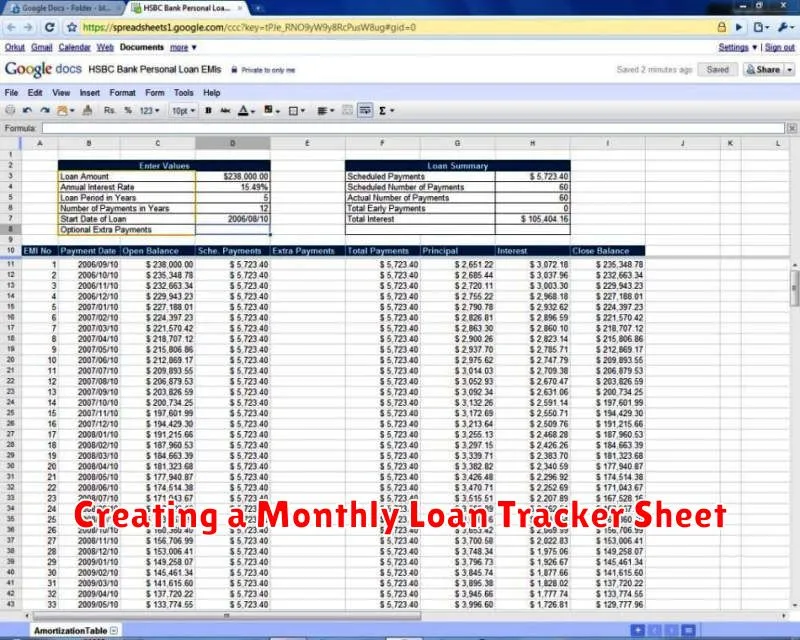

Creating a Monthly Loan Tracker Sheet

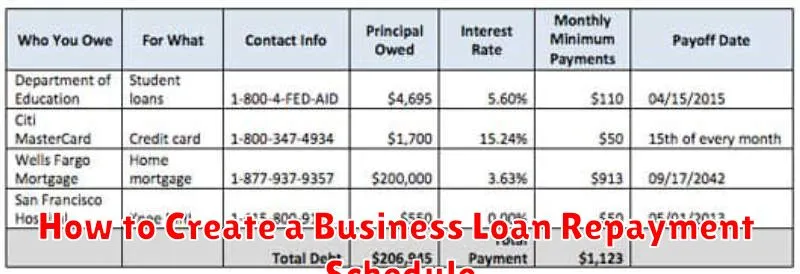

Creating a monthly loan tracker sheet is crucial for effectively managing your business loan repayments. This sheet will serve as a central repository for all your loan-related information, providing a clear overview of your repayment progress and outstanding balance.

The first step is to gather all the necessary information about your loan. This includes the principal loan amount, the interest rate, the loan term (in months), and the monthly payment amount. You can usually find this information in your loan agreement.

Next, design your spreadsheet. A simple table structure will work well. The columns should include: Month, Beginning Balance, Payment Amount, Interest Paid, Principal Paid, and Ending Balance. You can add extra columns for notes or any other relevant data as needed.

Now, you can populate the spreadsheet. The first row will contain your starting loan amount in the “Beginning Balance” column. Subsequent rows will be populated based on your monthly payment, which is usually calculated using an amortization schedule. The “Interest Paid” and “Principal Paid” portions are derived from the total monthly payment, considering the interest rate and remaining principal balance. The “Ending Balance” is simply the “Beginning Balance” minus the “Principal Paid.”

Calculating the interest paid and principal paid portions requires some formulas. Most spreadsheet software (like Microsoft Excel or Google Sheets) have built-in functions to calculate these values automatically based on your loan terms. Learning how to use these functions will significantly simplify the process and reduce the risk of errors. Utilize the PMT, IPMT, and PPMT functions to accurately determine the monthly payments, interest paid, and principal paid for each month, respectively.

Regularly update your loan tracker sheet. This will ensure that your records remain accurate and provide an up-to-date view of your repayment progress. Maintaining an accurate record will help you track your expenses and ensure on-time loan repayments.

How to Add Flexibility to Your Repayment Plan

Creating a flexible business loan repayment schedule is crucial for navigating unexpected financial challenges. A rigid plan can leave your business vulnerable if sales decline or unforeseen expenses arise. Building in flexibility allows you to adapt and avoid defaulting on your loan.

One key strategy is to negotiate a variable payment schedule with your lender. Instead of fixed monthly payments, explore options for adjusting payments based on your monthly revenue. This approach requires transparency and open communication with your lender, but it can provide significant relief during lean months.

Another important aspect is establishing a reserve fund. Setting aside a portion of your monthly revenue specifically for loan repayments can act as a buffer against unexpected downturns. This fund can cover payments during slow periods, preventing you from falling behind.

Consider including grace periods in your repayment schedule. These periods allow for temporary suspension or reduction of payments during specific circumstances, such as seasonal business slowdowns or major equipment repairs. Negotiating these periods upfront with your lender is essential.

Finally, explore options for loan refinancing or consolidation. If your business experiences significant financial difficulties, refinancing your loan with a longer repayment term or lower interest rate can alleviate pressure and provide much-needed breathing room. This option, however, often depends on your credit history and current financial situation.

Remember to always maintain open communication with your lender. Proactive communication about potential financial challenges can help you work together to develop a suitable solution and avoid defaulting on your loan.

Avoiding Late Fees and Missed Deadlines

Creating a robust repayment schedule is crucial for avoiding late fees and missed deadlines. A well-structured plan anticipates potential challenges and provides a clear path to timely payments.

Begin by carefully reviewing your loan agreement. Understand the payment amounts, due dates, and any applicable grace periods. Note the specific consequences of late payments, including the calculation of late fees and potential impacts on your credit score.

Utilize a calendar or planner, either digital or physical, to mark all payment due dates. Setting reminders, whether through your phone or email, is a proactive step to ensure you don’t miss crucial deadlines. Consider incorporating payment dates into your existing budgeting system.

For increased security, consider setting up automatic payments. This eliminates the risk of forgetting a payment and ensures timely fulfillment of your obligations. This method also provides a confirmation record of successful transactions.

If unforeseen circumstances arise, preventing timely payment, contact your lender immediately. Explain your situation and explore potential options, such as a temporary deferment or a revised payment plan. Open communication can often prevent the accumulation of late fees and potential damage to your credit standing. Proactive communication is key.

Regularly review your repayment schedule and adjust it as needed. Life changes can impact your finances; adapting your schedule ensures continued progress towards loan repayment. Consistency and vigilance are essential for successful repayment.

Using Accounting Tools to Stay on Track

Creating a robust business loan repayment schedule is crucial for financial success, but simply creating the schedule isn’t enough. You need the right tools to monitor your progress and ensure you stay on track. Accounting software plays a vital role in this process.

Accounting software provides a centralized location to record all your financial transactions, including loan payments. This allows for easy tracking of your repayment progress and provides a clear picture of your current financial status. Features like automated payment reminders and reporting tools significantly reduce the risk of missed payments and help maintain a healthy financial standing.

Beyond basic transaction recording, many accounting tools offer sophisticated features specifically beneficial for loan management. For instance, some programs allow you to directly link your loan details, automatically calculating interest and principal payments. This eliminates manual calculations and reduces the chance of errors, ensuring accuracy in your repayment schedule.

Budgeting tools integrated into accounting software can be invaluable. They allow you to forecast cash flow and project your ability to meet future loan payments. This proactive approach enables you to anticipate potential challenges and make necessary adjustments to your business operations or repayment plan before they become critical issues. Careful budgeting, facilitated by robust accounting software, is a cornerstone of successful loan repayment.

Choosing the right accounting software depends on the size and complexity of your business. Consider factors like the number of transactions, the level of detail required in your financial reports, and the integration with other business tools. Investing in a suitable accounting solution is an investment in the long-term financial health of your business and ensures smooth loan repayment.