Understanding the intricacies of a business loan term sheet is crucial for securing favorable financing for your venture. This document, often overlooked, outlines the key terms and conditions of a loan, impacting your cash flow, profitability, and overall financial health. Navigating this complex document requires a keen understanding of interest rates, repayment schedules, fees, collateral requirements, and other critical financial stipulations. This guide will provide you with the essential knowledge to effectively review and negotiate a business loan term sheet, empowering you to make informed decisions and secure the best possible loan terms for your business.

A well-negotiated business loan term sheet can be the difference between success and failure. Before signing any documents, it’s vital to thoroughly comprehend the loan amount, amortization schedule, prepayment penalties, and any restrictive covenants. Misunderstanding these critical aspects can lead to significant financial burdens and even jeopardize the viability of your business. This comprehensive guide will equip you with the tools and insights needed to confidently assess a term sheet, identify potential risks, and leverage your knowledge to negotiate a loan agreement that aligns with your business goals and financial capabilities. Learn how to decipher the legal jargon and financial complexities to ensure a mutually beneficial partnership with your lender.

What Is a Loan Term Sheet?

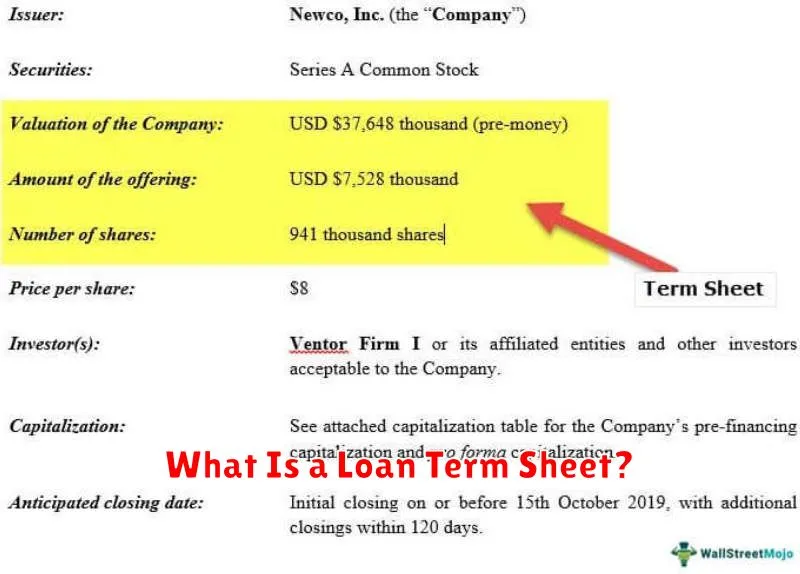

A loan term sheet is a non-binding document outlining the key terms and conditions of a proposed loan. It’s essentially a summary of the agreement between a lender and a borrower, serving as a starting point for negotiations before a formal loan agreement is drafted.

While not legally binding in its entirety, a term sheet is a crucial document. It lays out the essential financial aspects of the loan, including the loan amount, interest rate, repayment schedule, and any associated fees. It also typically includes details regarding collateral, covenants, and prepayment penalties.

The purpose of a term sheet is to provide both parties with a clear understanding of the proposed loan terms before investing significant time and resources in drafting a formal contract. This allows for early identification and resolution of potential disagreements, ultimately saving time and money.

It’s important to note that while a term sheet is not a legally binding contract, specific clauses within it might be, or the parties may agree to bind themselves to specific parts of the document. Careful review by legal counsel is therefore highly recommended before signing.

A well-structured term sheet will cover all the material aspects of the transaction, reducing the likelihood of disputes later on. Its clarity is paramount in ensuring both parties are on the same page regarding the financial implications of the loan.

Key Clauses You Need to Understand

Understanding a business loan term sheet requires careful attention to several key clauses. These clauses define the terms and conditions of the loan and significantly impact your business’s financial future. Failure to thoroughly review and comprehend these clauses can lead to unforeseen consequences.

One crucial aspect is the loan amount and the interest rate. The term sheet should clearly specify the total amount of funding you’ll receive and the annual interest rate charged. Pay close attention to whether the interest rate is fixed or variable, as this impacts your budgeting and long-term financial planning. Also, look for details on any fees associated with the loan, such as origination fees, prepayment penalties, or other charges.

The repayment schedule is another critical element. This clause outlines how and when you’ll repay the loan. Understand the length of the loan term, the frequency of payments (monthly, quarterly, etc.), and the total amount of interest you will pay over the life of the loan. It’s also important to note any grace periods offered.

Covenants are restrictions or requirements placed on your business as a condition of the loan. These covenants may relate to various aspects of your business operations, including financial performance, debt levels, and capital expenditures. Carefully review these covenants to ensure they are achievable and don’t unduly restrict your business’s growth potential. Breaching these covenants could have serious repercussions, including loan default.

Finally, the events of default clause specifies the circumstances under which the lender can declare your loan in default. Understanding the triggers for default and the lender’s remedies in case of default is paramount. This section should clearly outline the consequences of failing to meet the loan terms, such as acceleration of the debt or collateral seizure.

Interest Rate and Repayment Terms

The interest rate is a crucial element of any business loan. It represents the cost of borrowing money, expressed as a percentage of the principal loan amount. Understanding the interest rate is paramount to accurately calculating the total cost of the loan over its lifetime. Fixed interest rates remain constant throughout the loan term, offering predictability in repayment amounts. Conversely, variable or floating interest rates fluctuate based on market conditions, introducing an element of uncertainty into your financial planning. The term sheet should clearly state whether the rate is fixed or variable and, if variable, specify the benchmark index used for adjustments.

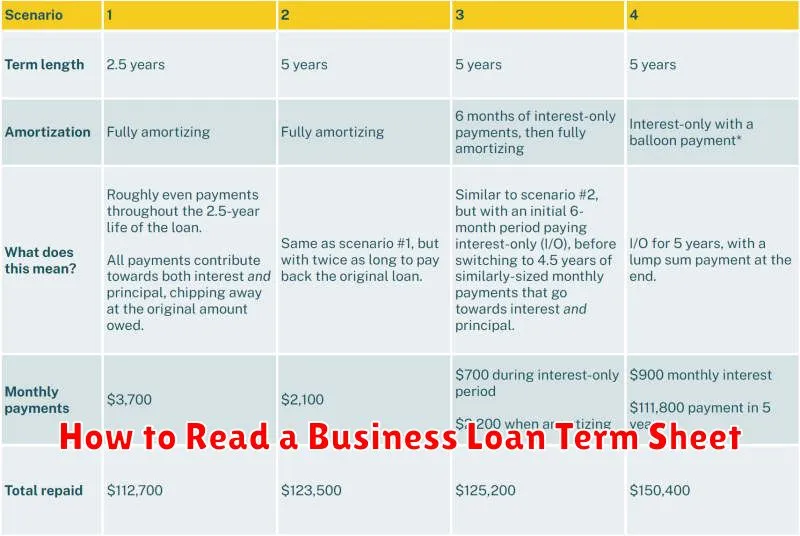

Repayment terms define the schedule for repaying the loan. This includes the loan term (the total length of the loan), the frequency of payments (e.g., monthly, quarterly, annually), and the amount of each payment. A shorter loan term generally results in higher monthly payments but lower overall interest costs, while a longer term leads to lower monthly payments but higher total interest paid. The term sheet will detail the specific repayment schedule, including the exact number of payments and the due dates. Understanding this schedule is essential for budgeting and managing cash flow.

Amortization, often specified in the repayment terms, describes how the loan payments are allocated between principal and interest. A standard amortization schedule typically begins with higher interest payments and gradually increases the proportion allocated to principal over time. Reviewing the amortization schedule clarifies the distribution of your payments and the remaining principal balance at various points during the loan term. Prepayment penalties, if applicable, should also be clearly detailed. These penalties may be imposed for paying off the loan early, potentially impacting your financial strategy.

Pay close attention to any mention of grace periods. These periods offer a temporary delay before payments begin, often used for initial setup or project completion. However, interest might still accrue during a grace period. Carefully examine the interest capitalization provisions; interest capitalization involves adding accrued but unpaid interest to the principal balance, increasing the overall amount owed. This can significantly impact the total cost of borrowing and should be considered when evaluating the repayment terms.

Collateral and Covenant Sections

The collateral section of a business loan term sheet outlines the assets the borrower pledges as security for the loan. This could include real estate, equipment, inventory, accounts receivable, or other valuable assets. Understanding the specific assets listed and the valuation process used is crucial. A detailed description of the collateral, including its location and condition, should be provided.

Careful consideration should be given to the type of collateral offered. For instance, readily marketable assets, like publicly traded securities, are generally considered superior collateral compared to less liquid assets, such as specialized equipment. The lender will likely conduct a thorough appraisal of the collateral to ensure its sufficient value to cover the loan amount. Any limitations on the lender’s ability to seize or liquidate the collateral should also be noted.

The covenant section details the borrower’s promises and restrictions during the loan term. These covenants are designed to protect the lender’s interests and ensure the borrower’s financial stability. Covenants often involve financial ratios (e.g., debt-to-equity ratio, current ratio) that must be maintained throughout the loan’s life. Failure to comply with these covenants can lead to default and potential repossession of the collateral.

Common covenants include restrictions on additional debt, dividend payments, and acquisitions. The term sheet should clearly specify the specific financial ratios, thresholds, and any reporting requirements. Affirmative covenants require the borrower to take specific actions, while negative covenants restrict the borrower from certain actions. Understanding the implications of each covenant is essential for assessing the feasibility and overall impact of the loan on the business.

Thoroughly reviewing both the collateral and covenant sections is paramount before signing a business loan term sheet. Negotiating favorable terms regarding both is crucial to securing a loan agreement that protects the borrower’s interests while achieving the lender’s risk mitigation objectives. Seeking professional advice from legal and financial experts is highly recommended before committing to any loan agreement.

Common Mistakes When Reviewing the Terms

One of the most frequent errors is failing to thoroughly read and understand the entire term sheet. Many borrowers focus only on the headline numbers, such as the loan amount and interest rate, neglecting crucial details buried within the fine print. This oversight can lead to unexpected costs and liabilities down the line.

Another common mistake is underestimating the importance of legal counsel. A business loan term sheet is a legally binding document, and navigating its complexities requires specialized knowledge. Seeking independent legal advice before signing anything is crucial to protecting your interests.

Many borrowers also fail to negotiate effectively. While a term sheet might seem like a take-it-or-leave-it proposition, there’s often room for negotiation on key terms. Failing to advocate for favorable terms can result in a less advantageous loan package.

Ignoring prepayment penalties is another significant mistake. These penalties can significantly impact your financial flexibility, making it costly to pay off the loan early. Carefully review the prepayment terms to ensure they align with your business’s anticipated growth and cash flow.

Finally, a lack of clarity on fees and expenses can be detrimental. Beyond the interest rate, numerous fees can accumulate, including origination fees, closing costs, and other charges. A comprehensive understanding of all associated expenses is essential for accurate budgeting and financial planning.

When to Ask for Revisions or Clarification

Reviewing a business loan term sheet requires careful attention to detail. It’s crucial to understand every clause and its implications for your business. Don’t hesitate to seek clarification on anything you don’t fully grasp.

You should request revisions or clarifications if you encounter any of the following:

- Unclear language or ambiguous terms: If any section is vaguely worded or open to multiple interpretations, seek clarification to avoid future disputes.

- Conflicting clauses: If two or more sections appear to contradict each other, immediately flag this inconsistency and request a resolution.

- Unacceptable terms or conditions: If any aspect of the loan – interest rates, fees, repayment schedule, collateral requirements – is unacceptable to you, you should negotiate for more favorable terms.

- Missing information: Ensure the term sheet comprehensively covers all essential aspects of the loan. Any omissions should be addressed promptly.

- Unrealistic expectations: If the terms seem unrealistic given your business’s financial standing or industry norms, seek clarification on the lender’s rationale.

Remember, a term sheet is a crucial document setting the stage for a potentially significant financial commitment. Proactive communication with the lender to address uncertainties is essential to ensuring you enter the agreement with a clear understanding of your obligations and rights. Don’t feel pressured to sign anything you don’t fully comprehend.