Considering co-signing a personal loan? This crucial decision carries significant financial responsibility and requires careful consideration. Before you commit, it’s essential to fully understand the implications and potential risks involved. This article will guide you through the key factors to evaluate, helping you make an informed decision about whether or not co-signing a loan is the right choice for your circumstances. We’ll cover everything from your credit score impact to the legal ramifications of default, ensuring you’re prepared for all possible outcomes.

Co-signing a personal loan can have profound effects on your financial health. Understanding the legal obligations, potential debt burdens, and the ways in which your credit report will be affected is paramount. Ignoring these critical aspects could lead to serious financial consequences, potentially harming your credit rating and damaging your relationship with the borrower. This guide provides a comprehensive overview to empower you to navigate this complex process confidently and responsibly. Learn how to protect yourself and make an informed decision about co-signing.

What Does It Mean to Be a Co-Signer?

Being a co-signer on a personal loan means you are legally responsible for repaying the loan if the primary borrower defaults. This is a significant financial commitment that should not be taken lightly.

Unlike a guarantor, a co-signer is equally responsible for the loan’s repayment. This means lenders can pursue you for the full amount owed, even if the primary borrower has assets or income that could be used to settle the debt. Your credit report will be affected if the borrower fails to make payments.

Essentially, you are jointly liable for the loan. Your creditworthiness is considered alongside the primary borrower’s when the loan application is assessed. Lenders often look at your credit score, income, and debt-to-income ratio to evaluate the risk associated with lending the money.

Before agreeing to co-sign, fully understand the terms of the loan agreement. This includes the loan amount, interest rate, repayment schedule, and all associated fees. Ensure you have a clear understanding of the legal responsibilities you are undertaking.

Consider the potential financial risks involved. If the borrower defaults, you could face significant financial hardship. You may be responsible for covering monthly payments, potentially impacting your own finances and credit score negatively. Thorough planning and a frank discussion with the borrower are essential before making this commitment.

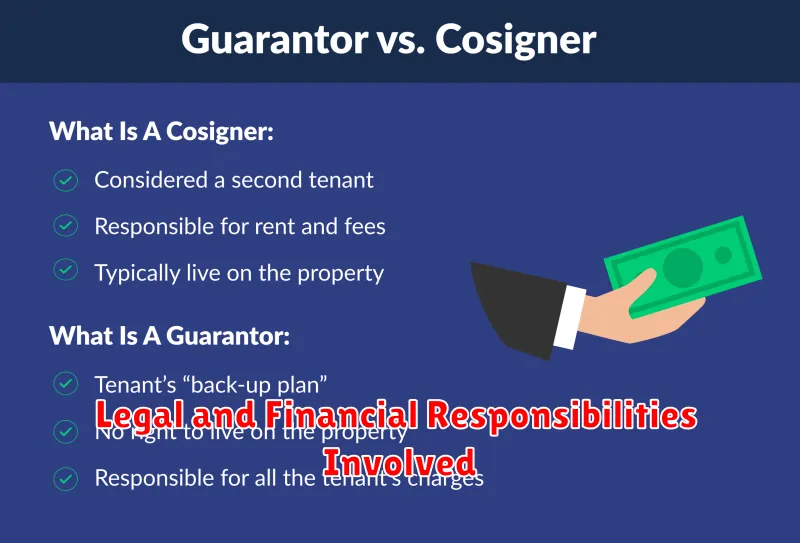

Legal and Financial Responsibilities Involved

Co-signing a personal loan carries significant legal and financial responsibilities. You are not merely a reference; you become equally liable for the loan’s repayment. This means that if the primary borrower defaults, the lender can pursue you for the entire outstanding balance.

Legally, you are bound by the loan agreement’s terms just as the primary borrower is. This includes adhering to the repayment schedule, interest rates, and any other stipulations outlined in the contract. Failure to meet these obligations can result in serious consequences, such as damage to your credit score, wage garnishment, and even legal action.

From a financial standpoint, co-signing exposes you to substantial risk. If the primary borrower fails to make payments, you become responsible for the entire debt. This could significantly impact your personal finances, potentially leading to debt overload, difficulty obtaining future credit, and financial hardship. It’s crucial to understand that your own financial situation could be jeopardized, even if you initially believed the primary borrower to be a low-risk candidate.

Furthermore, the legal ramifications extend beyond the immediate financial burden. Negative impacts on your credit history can affect your ability to secure loans, mortgages, and even rental agreements in the future. The long-term consequences of defaulting on a co-signed loan are far-reaching and can be difficult to overcome.

Therefore, before co-signing any loan, thoroughly review the loan agreement, assess your financial capacity to cover the debt in full, and carefully consider the potential legal risks involved. A thorough understanding of these responsibilities is paramount to making an informed decision.

How Co-Signing Affects Your Credit Report

Co-signing a loan is a significant financial commitment that carries substantial implications for your credit report. When you co-sign, you become equally responsible for repaying the loan as the primary borrower. This means the loan will appear on both your and the primary borrower’s credit reports.

Positive impacts on your credit report are possible if the borrower makes all payments on time. This timely payment history will be reflected on your credit report, potentially boosting your credit score. This demonstrates responsible borrowing behavior and strengthens your credit profile. However, it is important to remember that this positive impact is contingent upon the borrower’s responsible repayment behavior.

Conversely, negative consequences can arise if the primary borrower defaults on the loan. Late payments or missed payments will be recorded on your credit report, negatively affecting your credit score. This can lead to difficulty securing future loans or credit cards, as well as potentially higher interest rates. The severity of the negative impact depends on the length and extent of the delinquency.

Furthermore, the loan will remain on your credit report for the entire duration of the loan, typically seven years from the date of any missed payments, even if you are not directly involved in the loan’s origination. This can impact your credit utilization ratio and potentially lower your credit score. Therefore, thorough consideration should be given to the potential long-term effects before committing to co-signing.

In essence, co-signing a loan links your credit history with the primary borrower’s. The impact on your credit report is directly tied to the primary borrower’s repayment performance. While responsible repayment can be beneficial, default carries significant risks for your financial well-being.

Scenarios When Co-Signing Might Make Sense

While co-signing a personal loan carries significant risk, there are certain situations where it might be a justifiable decision. One such scenario involves assisting a close family member or friend with poor credit history who needs a loan for an essential purpose, such as medical expenses or home repairs. By co-signing, you essentially vouch for their ability to repay the loan, thus improving their chances of approval.

Another scenario could involve helping a loved one purchase a vital asset, like a car needed for work or a small business loan to help them get started. In these cases, the co-signer’s good credit can act as a significant buffer against risk for the lender, enabling the borrower access to funding they might otherwise be denied.

It’s also worth considering situations where the borrower has experienced a temporary setback impacting their credit score, such as a job loss or an unforeseen medical emergency. If you believe this is a temporary situation and the borrower is otherwise responsible, co-signing could be a way to bridge the gap until their financial situation stabilizes, allowing them to rebuild their credit while maintaining access to essential resources.

Finally, co-signing can be beneficial in situations where a lower interest rate is obtainable due to the co-signer’s excellent credit. The combined creditworthiness of the borrower and co-signer may lead to more favorable loan terms for both parties involved. However, it is crucial to carefully weigh the risks before proceeding.

Questions to Ask Before Agreeing

Before you co-sign a personal loan, it’s crucial to have a thorough understanding of your obligations and the potential risks involved. Asking the right questions can prevent significant financial hardship down the road.

First, you should clearly understand the loan amount, the interest rate, and the repayment terms. Knowing the total amount to be repaid, including interest, is critical. Ask for a detailed breakdown of all fees associated with the loan.

Next, it’s essential to thoroughly investigate the borrower’s creditworthiness. Obtain a copy of their credit report and assess their repayment history. Understanding their financial situation, including their income and expenses, will give you insight into their ability to repay the loan.

You should also have a clear understanding of your liability as a co-signer. Will you be held responsible for the full loan amount if the borrower defaults? What are the consequences for you if the borrower fails to make payments?

It’s advisable to explore alternative solutions for the borrower. Could they qualify for a loan without a co-signer? Are there other financial options that would pose less risk to you?

Finally, always get everything in writing. Ensure the terms of the co-sign agreement are clearly stated and that you fully understand your responsibilities. Review the document carefully and seek legal advice if needed.

Alternatives to Co-Signing a Loan

Co-signing a loan can be a significant commitment, exposing you to potential financial risk if the borrower defaults. Before taking on such responsibility, it’s crucial to explore alternative options that may be less risky.

One viable alternative is to help the borrower improve their credit score. A higher credit score will significantly increase their chances of loan approval without a co-signer. This may involve assisting them in paying down existing debt, disputing inaccurate credit reports, or simply encouraging responsible credit management. The time invested in this approach may ultimately benefit both parties.

Another option is to explore secured loans. These loans require collateral, such as a car or savings account, to secure the loan amount. This reduces the lender’s risk and may eliminate the need for a co-signer. The downside is that the borrower risks losing the collateral if they default on the loan.

Increasing the borrower’s income can also improve their chances of loan approval. This could involve assisting them in finding a higher-paying job or offering short-term financial support to help them stabilize their income. A consistent income stream demonstrates the borrower’s ability to repay the loan, making them a more attractive applicant.

Finally, consider the possibility of smaller loan amounts. A smaller loan may be easier for the borrower to secure without a co-signer, and the associated risks are proportionately less. This could mean opting for a smaller initial loan to achieve their goals or breaking the desired project into manageable smaller financial requests.

Each of these alternatives presents its own advantages and disadvantages; therefore, careful consideration of the borrower’s financial situation and the specifics of the loan are paramount before selecting the best course of action. Remember to thoroughly research all options and consult with a financial advisor if needed.