Effectively managing your finances requires vigilance, and utilizing credit card alerts is a crucial step in maintaining control over your spending. This guide will explore the various types of credit card alerts available and demonstrate how to strategically leverage them to stay on top of your credit card activity, preventing overspending and potential fraud. We’ll delve into how setting up timely notifications for transactions, balance updates, and suspicious activity can significantly improve your financial awareness and help you achieve your budgeting goals. Learn how to customize your alert preferences to receive notifications through your preferred method – email, SMS, or mobile app – ensuring you never miss a critical update.

Ignoring potentially problematic credit card transactions can lead to significant financial setbacks. By proactively employing credit card alerts, you gain immediate insights into your spending habits, allowing for timely intervention and correction. This proactive approach not only helps you track your spending against your budget, but it also provides an immediate warning system for detecting fraudulent activity. This empowers you to take swift action, minimizing potential losses and ensuring the security of your financial information. Mastering the use of credit card alerts is a fundamental step towards establishing strong financial habits and building a secure financial future.

Types of Alerts Most Issuers Offer

Credit card issuers typically offer a variety of alerts designed to keep you informed about your account activity. These alerts are usually customizable, allowing you to select the types and frequency of notifications that best suit your needs. Understanding these options is key to effectively using alerts for financial management.

One of the most common types is the transaction alert. This notifies you each time a purchase is made using your credit card. You’ll typically receive details like the amount, merchant, and date of the transaction. This is particularly helpful in quickly identifying any unauthorized activity.

Another valuable alert is the low balance alert. This warning lets you know when your available credit falls below a certain threshold you set. This prevents you from accidentally exceeding your credit limit and incurring over-limit fees. Setting a comfortable buffer is crucial for maintaining good financial health.

Payment due alerts remind you when your credit card bill is due. These timely reminders prevent late payments which can negatively impact your credit score. You can often customize these alerts to receive them several days before the due date.

Some issuers also provide alerts for suspicious activity. These alerts trigger when unusual spending patterns are detected on your account, such as multiple transactions in a short period or purchases far from your usual location. This proactive feature can help you detect and report potential fraud promptly.

Finally, credit score change alerts, while not offered by all issuers, can provide valuable insights into your credit health. These alerts notify you when there’s a significant change in your credit score, allowing you to investigate the cause and take necessary action if needed.

Setting Up Alerts for Payment Due Dates

Effectively managing your credit card accounts requires proactive monitoring. One of the most crucial aspects of this is setting up alerts for payment due dates. Missing a payment can negatively impact your credit score and lead to late fees.

Most credit card issuers offer various alert options through their online portals or mobile apps. These typically include email, text message (SMS), and even push notifications. You can usually customize these alerts to receive reminders a few days, a week, or even several weeks before your payment is due. Take advantage of this feature and tailor it to your preferences and payment schedule.

To set up these alerts, log in to your credit card account online or through the mobile app. Navigate to the “Alerts,” “Notifications,” or “Settings” section – the exact wording varies depending on the issuer. Look for the option to set reminders for payment due dates and choose your preferred notification method(s) and the desired timeframe for the alerts.

It’s recommended to set multiple alerts to ensure you don’t miss your due date. A first alert a few weeks before the due date can serve as a reminder to check your balance and budget for the payment. Then a second alert, closer to the due date (e.g., a few days prior), will provide a final push to ensure timely payment. This layered approach significantly reduces the risk of overlooking your payment deadline.

Remember to review your alert settings periodically. This ensures that your contact information and preferences are up-to-date and that you continue receiving crucial payment reminders. Properly configured due date alerts are a vital tool for responsible credit card management.

Spending Limit Alerts to Avoid Overuse

Spending limit alerts are a crucial feature offered by most credit card companies. These alerts notify you when your spending approaches or exceeds a predetermined threshold. Setting up these alerts is a proactive step towards responsible credit card management and preventing overspending.

By utilizing spending limit alerts, you gain real-time awareness of your spending habits. This allows you to consciously monitor your expenses and make informed decisions before exceeding your budget. The timely notification acts as a check, preventing impulsive purchases that could lead to exceeding your credit limit and incurring unnecessary fees.

The threshold for your alert is customizable, allowing you to set it at a level that aligns with your financial goals and comfort zone. Some card issuers even provide the option to set multiple alerts at different spending levels. This graduated approach enables you to receive notifications at several stages, offering multiple opportunities to reassess your spending.

Choosing the right alert method is also important. Many credit card companies provide a variety of alert options, such as email, SMS text messages, or mobile app notifications. Selecting the method that best suits your communication preferences ensures that you receive the alerts promptly and efficiently.

Beyond preventing overspending, spending limit alerts also offer an early warning system for potential fraudulent activity. If you receive an alert for a purchase you didn’t make, you can promptly contact your credit card company to report the suspicious activity and minimize potential financial loss.

Fraud Alerts for Suspicious Transactions

Credit card fraud alerts are a crucial feature offered by most card issuers to help you monitor your account activity and detect potentially fraudulent transactions. These alerts, typically delivered via email, text message, or through your online banking portal, notify you of unusual spending patterns or transactions that might indicate unauthorized access to your account.

The specific triggers for these alerts vary by issuer, but generally include transactions exceeding a pre-set spending limit, purchases made in unfamiliar locations, or multiple transactions within a short period. Some issuers also employ sophisticated algorithms that analyze your spending habits to identify anomalies that might signify fraudulent activity, even if the individual transaction amounts are within your normal range.

Upon receiving a fraud alert, it’s vital to immediately review the details of the flagged transaction. Verify whether you authorized the purchase. If the transaction is indeed fraudulent, you should contact your card issuer’s fraud department as quickly as possible. The sooner you report suspicious activity, the quicker the issuer can take steps to secure your account and limit your potential losses.

Remember to carefully review your monthly statements, even if you receive real-time alerts. Sometimes, fraudulent activity might go unnoticed by automated systems, making regular statement reviews an essential part of fraud prevention. Paying close attention to both your online alerts and your physical statements provides a comprehensive approach to identifying and addressing potentially fraudulent transactions.

Actively monitoring your credit card accounts through a combination of alerts and statement reviews significantly enhances your ability to detect and prevent fraudulent activity, safeguarding your financial security.

Benefits of Real-Time Notifications

Real-time credit card notifications offer a significant advantage in managing your finances effectively. The immediate updates provide a level of control and awareness previously unavailable, empowering you to proactively address potential issues.

One key benefit is the ability to detect fraudulent activity swiftly. With instant alerts for every transaction, suspicious purchases become immediately apparent, allowing you to contact your bank promptly and minimize potential losses. This proactive approach is crucial in safeguarding your funds.

Beyond fraud prevention, real-time notifications offer enhanced budgetary control. By receiving updates on each spending event, you maintain a constant awareness of your spending habits. This immediacy helps prevent overspending and fosters more mindful financial decisions. Tracking your expenses in real-time allows for more accurate budgeting and financial planning.

Furthermore, these notifications provide peace of mind. Knowing that you’ll receive immediate alerts for any credit card activity reduces anxiety related to unauthorized transactions or unexpected expenses. This consistent monitoring contributes to a more relaxed and confident approach to managing your finances.

Finally, real-time alerts facilitate faster dispute resolution. If an error occurs, such as a duplicate charge or an incorrect amount, you can address the problem quickly with the bank, utilizing the detailed transaction information provided in your notification. This quick response often leads to efficient resolution of billing disputes.

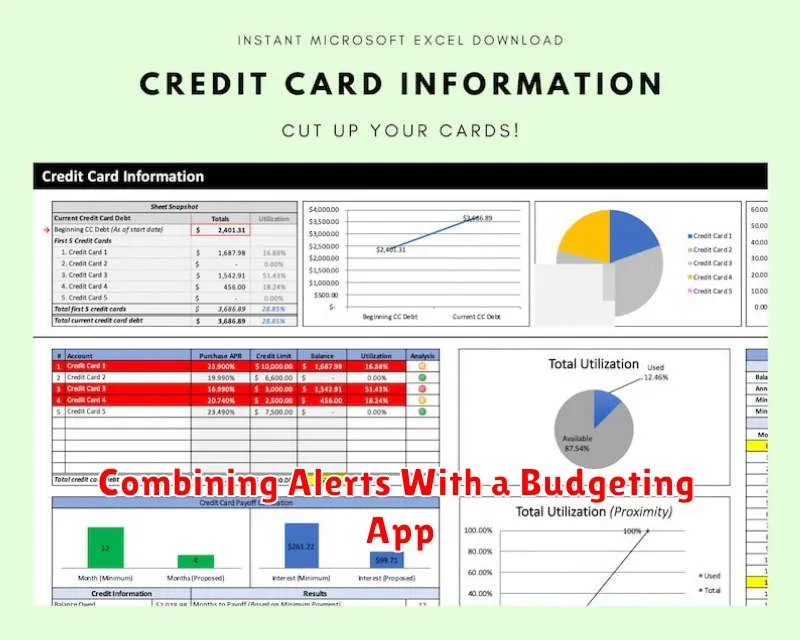

Combining Alerts With a Budgeting App

Credit card alerts, while helpful on their own, become even more powerful when integrated with a budgeting app. This combination provides a comprehensive approach to financial management, offering real-time insights and proactive control over your spending.

Many budgeting apps allow you to link your credit cards, automatically importing transaction data. This eliminates the need for manual entry, saving you valuable time and reducing the risk of errors. By linking your accounts, you can instantly see how your spending aligns with your budget categories, receiving visual representations of your progress (or lack thereof).

The synergy between alerts and budgeting apps is particularly effective in identifying potential overspending. When a credit card alert notifies you of a large or unusual purchase, you can immediately consult your budgeting app to assess its impact on your financial goals. This allows you to make informed decisions, potentially adjusting your spending habits to stay within budget.

Furthermore, some budgeting apps offer customized alert features. You might set up notifications when you approach a spending limit in a specific category, or receive a warning if a transaction exceeds a predefined threshold. This proactive approach empowers you to make conscious spending decisions, preventing unexpected overdrafts or exceeding your credit limit.

By combining the immediate feedback of real-time credit card alerts with the organized overview provided by a budgeting app, you gain a significantly improved understanding of your spending patterns. This holistic approach fosters better financial discipline and facilitates informed decision-making, ultimately contributing to a healthier financial outlook.