Have you discovered an unauthorized charge, a billing error, or a discrepancy on your recent credit card statement? Don’t panic! Addressing credit card billing errors promptly is crucial to protecting your credit score and your finances. This comprehensive guide outlines the essential steps involved in effectively disputing inaccurate charges and resolving credit card billing disputes. Learn how to navigate the process, understand your rights, and successfully resolve the issue, ensuring your account accuracy and financial well-being.

Disputing a credit card charge might seem daunting, but with the right knowledge and approach, it’s a manageable process. We’ll walk you through how to identify billing errors, gather necessary documentation, and effectively communicate with your credit card issuer to resolve the problem. Whether it’s a fraudulent transaction, a duplicate charge, or a simple mathematical mistake, this guide provides a clear, step-by-step plan to help you successfully dispute errors on your credit card bill and reclaim your financial peace of mind. We cover everything from initial contact to appealing a decision, empowering you to take control of your credit card account.

Why Billing Errors Happen

Billing errors on credit card statements are unfortunately common, stemming from a variety of sources. Understanding these potential causes can help you effectively dispute any inaccuracies.

One frequent culprit is human error. Data entry mistakes, whether by the merchant or the credit card company, can lead to incorrect charges. This includes mismatched amounts, incorrect descriptions of purchases, or even charges for items you never bought.

System glitches are another major contributor. Technical problems within a merchant’s point-of-sale (POS) system or the credit card processing network can result in duplicate charges, incorrect transaction dates, or completely missing information.

Fraudulent activity can manifest as unauthorized transactions, often appearing as purchases you didn’t make. This necessitates immediate attention and reporting to both your credit card company and relevant authorities.

Pricing discrepancies can arise when a merchant advertises one price but charges a different amount. This often occurs due to mistakes in pricing signage, online listings, or even accidental mis-keying at the checkout.

Finally, billing cycle misalignments can create confusion. If a transaction occurs right at the end of one billing cycle and posts to the next, it can easily lead to misinterpretations of your statement.

Steps to Take When You Spot an Error

The first step is to carefully review your credit card statement. Identify the specific transaction or charge you believe is incorrect. Note the date, amount, and merchant involved. Gathering this information will be crucial for your dispute.

Next, contact your credit card issuer immediately. Don’t delay; most companies have deadlines for disputing charges. Find their customer service number on the back of your card or their website. Be prepared to explain the error clearly and concisely, referencing the information you’ve already gathered.

Keep detailed records of all communication with your credit card company. This includes the date and time of each call, the name of the representative you spoke with, and a summary of the conversation. If possible, obtain a reference number for your dispute.

Submit a formal written dispute. While a phone call is a good first step, many credit card companies require a written dispute for formal processing. This letter should reiterate the details of the error and include any supporting documentation you have, such as receipts or cancelled checks. Send this letter via certified mail with return receipt requested to ensure proof of delivery.

Be patient and persistent. Resolving a credit card dispute can take time. Follow up on your dispute regularly to check on its progress. Keep copies of all correspondence and documentation for your records. If your dispute isn’t resolved to your satisfaction, you may need to escalate the issue through further avenues.

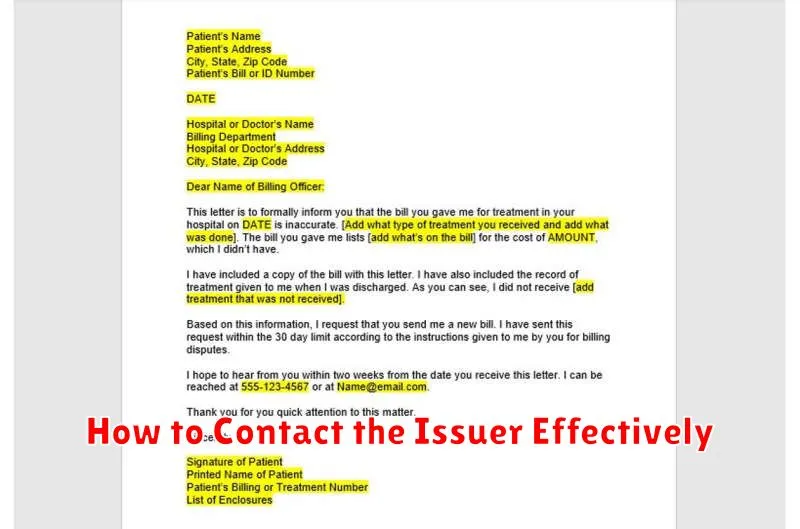

How to Contact the Issuer Effectively

Disputing an error on your credit card bill requires effective communication with your issuer. Before you begin, gather all relevant documentation, including your credit card statement showing the disputed transaction, any receipts or proof of purchase, and a detailed description of the error.

The most effective way to contact your issuer is typically via phone. Look for a dedicated customer service number on the back of your credit card or on your statement. Be prepared to spend time on hold; many issuers experience high call volumes. When you reach a representative, be polite, calm, and clearly explain the nature of the disputed transaction. Reference your account number and the date of the transaction.

If a phone call isn’t successful, or if you prefer written communication, consider sending a certified letter. This provides proof of delivery and ensures your complaint is received. Include all supporting documentation mentioned previously. Keep a copy of your letter for your records. Clearly state the amount you are disputing and your desired resolution. Note the deadline for responding to disputes, often outlined in your cardholder agreement.

You can also explore contacting your issuer through their online portal or mobile app. Many issuers offer secure messaging systems within their online platforms where you can submit a dispute directly. This method can provide a written record of your communication, similar to sending a letter. However, always confirm the receipt of your message and the steps the issuer will take to address your dispute.

Regardless of your chosen communication method, maintain a record of all interactions with your issuer, including dates, times, names of representatives, and summaries of conversations. This documentation is crucial if the dispute process requires escalation.

What Your Rights Are Under Law

Under the Fair Credit Billing Act (FCBA), you have specific rights when disputing errors on your credit card bill. This act protects consumers from inaccurate or unfair billing practices by credit card companies.

Key rights under the FCBA include:

- The right to dispute billing errors in writing within 60 days of the error appearing on your statement.

- The right to have your account temporarily suspended while the dispute is investigated. This means that the creditor cannot collect or report on the disputed amount during the investigation.

- The right to receive a written acknowledgment of your dispute within 30 days of its receipt.

- The right to a written response within two billing cycles (but no more than 90 days), explaining the credit card company’s findings and resolution of the dispute.

- The right to have the inaccurate information removed from your credit report if the credit card company determines that the dispute is valid.

- Protection against unfair collection practices while the dispute is pending.

Important Considerations:

- Your dispute must be in writing and include specific details about the error, such as the date of the transaction, the amount, and why you believe it’s incorrect.

- Keep copies of all correspondence with the credit card company throughout the process.

- If the credit card company fails to respond within the legally mandated timeframe or fails to resolve the issue fairly, you may have the option to take further action, potentially involving consumer protection agencies or legal counsel.

Understanding your rights under the FCBA is crucial for effectively disputing errors on your credit card bill and protecting your financial well-being. Familiarizing yourself with these rights empowers you to navigate the process confidently and achieve a fair resolution.

How Long It Takes to Resolve a Dispute

The timeframe for resolving a credit card dispute can vary significantly depending on several factors. Complexity of the issue plays a key role; a simple, easily verifiable error will generally resolve faster than a dispute involving multiple transactions or conflicting evidence.

The creditor’s policies and procedures also influence processing time. Some institutions are known for their efficient dispute resolution processes, while others may take longer. It’s wise to familiarize yourself with your specific credit card company’s policies regarding dispute resolution.

The volume of disputes the credit card company is currently handling can also create delays. During peak periods or times of increased consumer complaints, processing times may be longer than average.

While the Fair Credit Billing Act mandates a response within 30 days of receiving your dispute, this doesn’t necessarily mean the dispute will be fully resolved within this timeframe. The investigation itself can take longer, potentially several weeks or even months in more complex cases. You should anticipate a response within that initial 30-day period, but complete resolution could extend beyond.

Finally, the availability of supporting documentation can significantly impact the speed of resolution. Providing complete and accurate documentation, such as receipts, statements, and communication records, will expedite the process. Conversely, incomplete or missing documentation may lead to delays as the creditor seeks further information.

Tracking Resolution and Getting Updates

Once you’ve disputed a charge on your credit card bill, it’s crucial to track the progress of your dispute and obtain regular updates. This ensures the process moves forward efficiently and that you’re kept informed every step of the way.

Most credit card companies provide online portals or mobile apps where you can monitor the status of your dispute. These platforms often provide a detailed timeline of events, including the date the dispute was submitted, the dates of any communications with the card issuer, and the final resolution. Regularly checking these resources is recommended.

If you’re unable to track your dispute online, or if you prefer direct communication, don’t hesitate to contact your credit card issuer directly. Keep a record of all communications, including dates, times, and the names of the representatives you speak with. This documentation can prove invaluable if you encounter further issues.

When contacting your issuer, be sure to have your account number, the date of the transaction in question, and a detailed description of the reason for the dispute readily available. This will help expedite the process and allow them to quickly access the relevant information.

Remember, the timeframe for resolving a credit card dispute can vary, depending on the complexity of the issue and the card issuer’s internal processes. Be patient but persistent in your efforts to obtain updates and ensure a fair resolution. If you feel the process is taking unreasonably long or that your concerns are not being adequately addressed, consider escalating the matter to a higher authority within the credit card company.