Maintaining a strong credit history is crucial for securing favorable interest rates on loans, mortgages, and even securing better deals on insurance. A significant factor in your credit score is the length of your credit history, often measured by the age of your oldest credit card account. Closing this account, even if it’s an old, unused card, can negatively impact your credit score and potentially cost you money in the long run. This article will explore the risks associated with closing your oldest credit card and offer practical strategies to help you avoid this potentially damaging financial decision.

Many individuals mistakenly believe that closing an inactive credit card will improve their credit score. However, this is often not the case. Your credit score is influenced by several factors, including your credit utilization ratio, payment history, and the average age of your accounts. Closing your oldest account significantly impacts the average age of your credit history, potentially leading to a credit score decrease. Learn how to strategically manage your oldest credit card without harming your financial standing, and uncover the benefits of preserving this valuable asset for a better credit future. This guide will empower you to make informed decisions about your credit health and protect your financial well-being.

Why Your Oldest Card Matters for Credit History

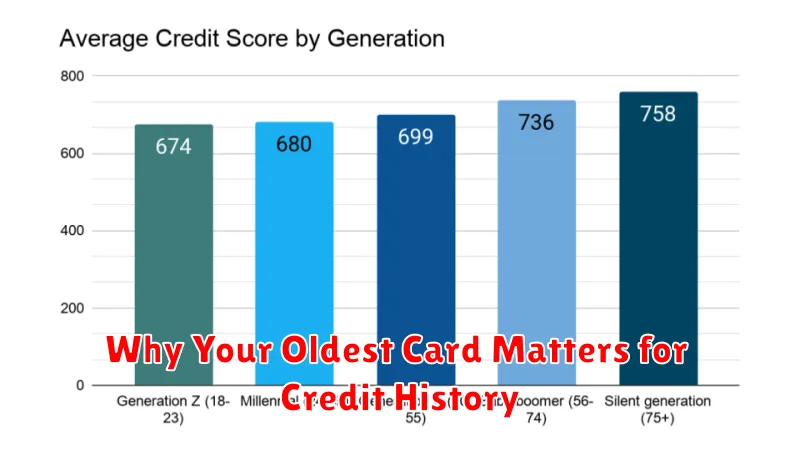

Your oldest credit card plays a significant role in your overall credit health. It’s a key factor in calculating your credit age, a crucial element of your credit score.

Credit age refers to the average age of your credit accounts. Lenders consider this because a longer credit history generally indicates a more responsible borrowing pattern. A longer history demonstrates your ability to manage credit over an extended period, mitigating the risk associated with lending to you.

Your oldest card, therefore, significantly impacts your average credit age. Even if you have newer cards with excellent payment histories, closing your oldest account will immediately lower your average age. This negative impact can be substantial, potentially resulting in a lower credit score.

Maintaining your oldest card, even if you don’t actively use it, offers a substantial benefit to your credit profile. Its continued existence positively contributes to your credit age, showcasing your long-term creditworthiness to potential lenders.

In short, while managing multiple credit accounts is important, keeping your oldest card open is a strategic move towards building and maintaining a strong credit history and a favorable credit score.

Common Reasons People Close Old Cards

Many individuals close old credit card accounts for a variety of reasons, often without fully considering the long-term consequences. One prevalent reason is the desire to simplify finances. Managing numerous accounts can feel overwhelming, leading some to consolidate their debt or reduce the number of monthly statements they receive.

Another significant motivator is the presence of annual fees. While some cards offer valuable benefits that justify the annual cost, many cardholders find these fees burdensome, especially if they rarely utilize the card’s perks. Closing the account seems like a straightforward solution to eliminate this recurring expense.

Low credit limits on older cards can also prompt closure. As credit needs evolve, cardholders may find the existing limit insufficient for their spending habits. Rather than requesting a credit limit increase, which isn’t always guaranteed, closing the account and opening a new one with a higher limit appears easier, although this can be a mistake.

Finally, a change in personal circumstances, such as a job loss or a move, can lead to the closure of older cards. The card may no longer be seen as relevant or necessary, contributing to the decision to close the account.

How to Keep the Card Active Without Overspending

Maintaining an active credit card, especially your oldest one, is crucial for a healthy credit score. Longevity of credit accounts is a significant factor in credit scoring models. However, simply using the card isn’t enough; you need to do so responsibly to avoid accumulating debt and harming your credit.

One effective strategy is to use the card for small, recurring expenses. This could include things like your streaming subscription, a monthly phone bill payment, or even your coffee shop purchases. By making these small, manageable payments regularly, you demonstrate consistent responsible credit usage without significantly increasing your debt.

Another approach is to set up automatic payments for a small amount each month. This ensures the card remains active and shows consistent activity to credit bureaus, without requiring you to actively remember to use it. Choose an amount that fits comfortably within your budget and won’t strain your finances. Always ensure the automatic payment amount is manageable and you will not incur any overdraft fees.

Careful budgeting is key to avoiding overspending. Before using the card, determine how much you can comfortably spend and stick to that amount. Track your spending diligently to ensure you stay within your budget and avoid accumulating unnecessary debt. Many banking apps offer easy-to-use budgeting tools that can help.

Regularly reviewing your credit card statement is crucial. Identify any unauthorized charges or discrepancies immediately and report them to your bank. Monitoring your spending patterns also helps you maintain a clear understanding of your financial situation and avoid accidental overspending.

Alternatives to Cancellation

Before considering closing your oldest credit card account, explore alternative options that can help you maintain a healthy credit profile without the negative consequences of account closure. One key strategy is to simply reduce your spending on that card. This minimizes your utilization rate, a crucial factor in your credit score.

Another effective approach is to make it your primary card for small, recurring purchases. While you shouldn’t make large purchases that you cannot pay in full, using the card for consistent, small transactions demonstrates continued activity, which can be beneficial to your credit history. This shows lenders you are still actively managing the account and maintaining a good payment history.

If you’re facing high annual fees, consider negotiating with your credit card company. They may be willing to waive or reduce the fee, especially if you’re a long-standing customer with a good payment history. This negotiation can save you money while preserving the valuable age of your account, which significantly contributes to a strong credit score.

You can also explore the possibility of downgrading your card. Some issuers offer the option to convert a premium card with high fees to a basic card with lower or no annual fee. This preserves your account’s history without the financial burden of high annual fees. Remember to check the terms and conditions of this change to ensure it aligns with your financial goals.

Finally, consider using the card for automated payments, such as recurring subscriptions or utility bills. This demonstrates responsible use of credit and consistent payment history, even if the amount spent on the card is minimal. Remember consistent positive activity is crucial for maintaining a high credit score.

What to Do If the Issuer Closes It for Inactivity

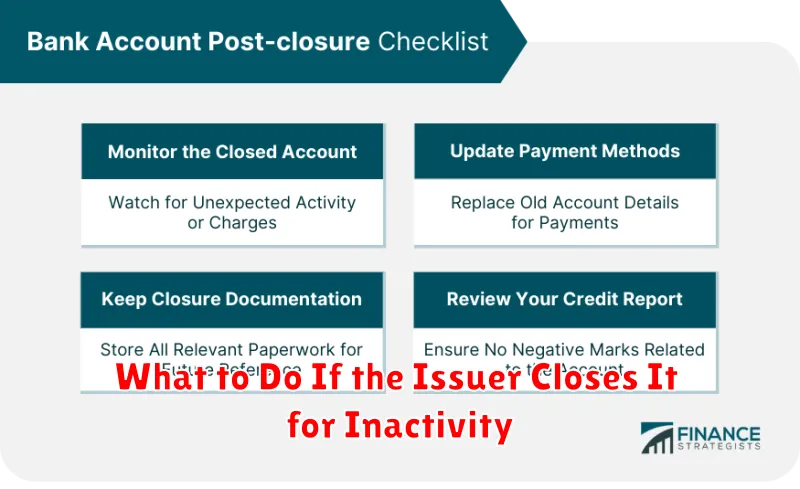

If your oldest credit card account is closed due to inactivity, despite your best efforts to prevent it, there are steps you can take to mitigate the negative impact on your credit score. Understanding the reasons behind the closure is crucial. Many issuers have specific inactivity policies, often involving a period of no activity (e.g., no transactions or payments) before closing the account.

First, review your credit report to confirm the account closure and understand its effect on your credit score. Look for any negative notations associated with the closure. Then, contact the credit card issuer directly to understand why your account was closed. It’s possible there was a miscommunication or an oversight on their part. Document this conversation carefully.

Next, consider applying for a new credit card to offset the loss of your oldest account’s positive credit history. Focus on cards with benefits that align with your spending habits. Building a long history with a new card will eventually help rebuild the length of your credit history.

Finally, maintain good credit habits. Continue paying your bills on time and keep your credit utilization low. These steps demonstrate responsible credit management and will improve your chances of building a strong credit profile despite the closure.

Remember that while a closed account impacts your credit history, it won’t necessarily ruin your credit score. Proactive steps, as outlined above, can help mitigate the consequences and ensure your credit remains healthy.

How to Monitor Your Credit Score After Account Changes

Closing a credit card account, especially your oldest one, can significantly impact your credit score. Even if you’re meticulously managing your finances, you should carefully monitor your credit report and score following such a change. This proactive approach helps you catch potential problems early.

There are several ways to track your credit score. Many credit card companies offer free credit score monitoring as a benefit to their cardholders. Take advantage of this if your issuer provides it; it allows for regular, convenient checks. Alternatively, you can sign up for a credit monitoring service from a reputable company. These services often provide detailed reports and alerts about changes to your credit profile. Remember to compare features and pricing before committing.

Beyond score tracking, regularly reviewing your credit report is crucial. You can obtain a free credit report annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion) through AnnualCreditReport.com. Scrutinize the report for accuracy, ensuring all account information, including the closed credit card, is reported correctly. Pay close attention to the details of the closed account to confirm its status and impact on your credit history.

Understanding how your credit utilization changes after account closure is also important. Your credit utilization ratio (the amount of credit you’re using compared to your total available credit) significantly impacts your credit score. Closing an older account may reduce your available credit, potentially increasing your utilization ratio if you don’t adjust your spending habits. Consequently, diligently monitor this metric following any account changes.

Finally, be aware that your credit score may fluctuate in the months following a credit account change. Don’t panic if you see a minor dip – this is sometimes a normal occurrence. However, a significant and sustained drop could signal a problem requiring immediate attention. In such instances, carefully review your credit report and contact the credit bureaus or the relevant lenders if discrepancies are found.