Are you planning to purchase a new home and are confused about mortgage rates? Securing a mortgage rate lock could be a crucial decision in your home-buying journey. A mortgage rate lock guarantees a specific interest rate for a set period, shielding you from potential increases in rates which can significantly impact your monthly payments. This article will delve into the intricacies of mortgage rate locks, explaining what they are, how they work, and whether or not they are the right choice for your home financing needs. Understanding mortgage rate locks is essential for making informed decisions during the often-stressful process of obtaining a home loan.

The decision of whether or not to lock your mortgage rate is a complex one, dependent on various factors including the current economic climate, your personal financial situation, and the length of time until your closing date. Fluctuations in the mortgage market can lead to uncertainty, and a rate lock offers a level of predictability, providing peace of mind amidst the complexities of home buying. We’ll explore the pros and cons of locking your mortgage rate, offering guidance to help you determine if a rate lock is the optimal strategy for you. This article aims to empower you with the knowledge necessary to navigate the world of mortgage rates and make the most financially sound decision.

What Is a Mortgage Rate Lock?

A mortgage rate lock is a contract between you and your lender that guarantees a specific interest rate and points for a set period. This protects you from rising interest rates during the time it takes to close on your home purchase. Without a rate lock, your interest rate could fluctuate up or down until the final closing of your loan.

The length of the rate lock varies, typically ranging from 30 to 60 days, but some lenders offer longer periods. The rate lock period begins once your lender receives your signed loan application and all necessary documentation. This period allows you time to complete the home purchase process, including appraisal, inspections, and underwriting.

Interest rates are dynamic and subject to change based on various economic factors. A rate lock gives you the certainty of a fixed rate, eliminating the risk of your monthly payments increasing due to unexpected shifts in market conditions. While you’ll pay points upfront (that is, fees) for the rate lock, in a rising interest rate environment the savings on your interest payments over the life of the loan can far outweigh those points. In a falling interest rate environment, however, the points may not be worth it, as you could find a lower rate elsewhere without locking it in.

It’s important to understand the terms and conditions of your rate lock agreement. These may include stipulations on changes to your loan application or property details that could void the lock. Any such changes should be promptly reported to your lender.

Points, often expressed as a percentage of the loan amount, are sometimes used in conjunction with rate locks. A lower interest rate typically involves paying more points upfront, while a higher interest rate might require fewer or no points. The appropriate balance will depend on your individual circumstances and financial goals.

When to Lock a Rate and for How Long

The decision of when to lock a mortgage rate is crucial, as it directly impacts your final loan cost. Several factors influence this timing. A rising interest rate environment generally encourages earlier rate locking, while a stable or falling market might allow for a more flexible approach. Market predictions, while not foolproof, play a significant role. Consulting with a mortgage professional can provide valuable insights into current market trends and potential future movements.

The length of the rate lock is another key consideration. Lock periods typically range from 30 to 60 days, with some lenders offering longer options. Choosing a shorter lock might allow you to potentially benefit from a rate decrease, but increases the risk of rates rising. Conversely, a longer lock offers more certainty but might mean missing out on potential rate improvements. The optimal duration depends on your individual risk tolerance and the prevailing market conditions.

Your personal circumstances also contribute to the decision-making process. Factors such as the urgency of your home purchase, your comfort level with risk, and the strength of your financial situation are all relevant. A buyer with a flexible closing date might opt for a shorter lock, whereas someone with a tighter timeline may prefer the security of a longer lock period.

Understanding the lock-in fee associated with various lock periods is crucial. While a longer lock might offer greater peace of mind, it often comes with a higher associated fee. It’s important to weigh the cost of the lock against the potential risk of rate fluctuations and your closing timeline.

Ultimately, the ideal time and duration for locking a mortgage rate involves careful consideration of various factors. Professional guidance is highly recommended to navigate this process effectively and make informed decisions that align with your specific financial situation and goals.

Pros and Cons of Locking Your Rate

Locking your mortgage rate offers several key advantages. A primary benefit is rate certainty. In a fluctuating market, locking your rate protects you from potentially rising interest rates, ensuring predictability in your monthly payments. This provides financial peace of mind, especially during times of economic uncertainty. Furthermore, locking allows you to budget more effectively, knowing precisely what your mortgage payments will be once you close on the loan.

However, locking your rate isn’t without drawbacks. A significant consideration is the potential for lost opportunity. If interest rates fall after you lock, you’ll miss out on the chance to secure a lower rate. The length of the lock period is crucial; longer locks often come with higher fees, reducing potential savings. Lastly, you may find yourself locked into a rate that isn’t the most competitive, especially if the market experiences a significant shift during the lock period. Therefore, a careful evaluation of the current market and your personal risk tolerance is essential before making a decision.

Another important factor to consider is the lock-in period itself. While longer lock-in periods might provide greater security, they typically come with a higher price tag and less flexibility. Shorter periods, conversely, offer more agility, but carry greater risk of rate increases.

How Floating Rates Compare

A floating rate mortgage, also known as an adjustable-rate mortgage (ARM), features an interest rate that changes periodically throughout the loan term. These fluctuations are typically tied to an underlying index, such as the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR), plus a margin set by the lender.

In contrast, a fixed-rate mortgage boasts a consistent interest rate for the entire loan duration. This predictability makes budgeting and financial planning significantly easier. Borrowers know exactly how much they will pay each month, barring any changes in property taxes or insurance premiums.

The primary advantage of a floating rate mortgage lies in its potentially lower initial interest rate. This can lead to smaller monthly payments during the early years of the loan. However, this benefit comes with significant risks. If interest rates rise, monthly payments can increase substantially, potentially leading to financial strain.

The disadvantage of a fixed-rate mortgage is the potentially higher initial interest rate compared to a floating rate mortgage. While monthly payments remain constant, the total interest paid over the life of the loan may be greater. This is particularly true if interest rates remain relatively low throughout the loan term.

The choice between a floating and fixed-rate mortgage depends heavily on individual circumstances and risk tolerance. Predictability is a key consideration. Those averse to uncertainty may prefer the stability of a fixed-rate mortgage, even if it means paying more in total interest. Conversely, those comfortable with some risk and anticipating potentially lower interest rates in the future might favor a floating rate mortgage for lower initial payments.

Typical Lock Fees and Conditions

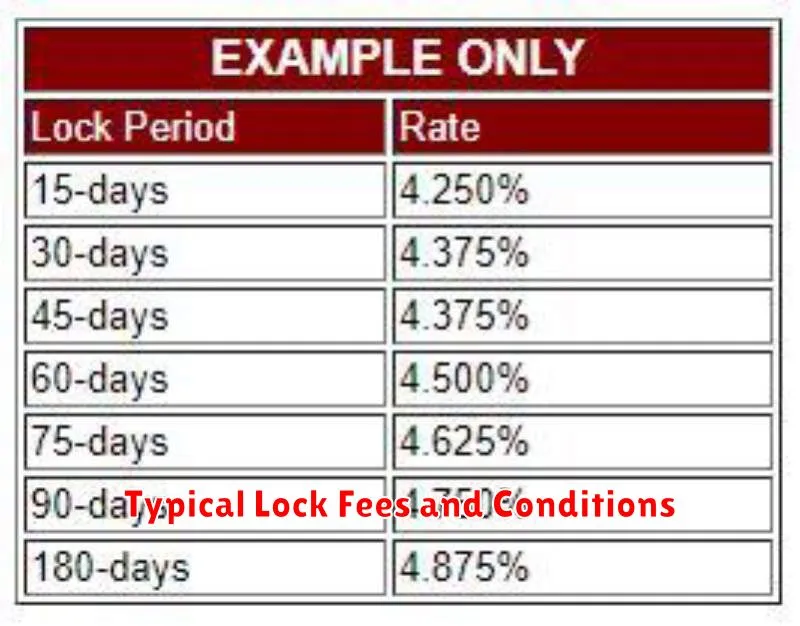

Locking in your mortgage rate typically involves a fee, the amount of which varies depending on the lender and the type of lock you choose. These fees can range from $0 to several hundred dollars, sometimes even exceeding $1,000 for certain circumstances or longer lock periods.

The lock period itself is another crucial condition. This refers to the length of time your interest rate is guaranteed. Common lock periods are 30, 45, or 60 days, but longer periods are sometimes available at an increased fee. It is important to understand that extending the lock period usually comes with a higher associated cost.

Float-down options are sometimes offered, allowing you to lower your rate if rates drop during your lock period. However, these options often come with extra fees. Carefully consider whether this additional cost is justified given the potential for rate improvement.

Lock expiration is another key condition. If you don’t close on your loan before the lock expires, you may have to re-lock, meaning you may be subject to the current, potentially higher, interest rates. This could result in significantly increased monthly payments. Always carefully review the lock agreement for the specific details of the expiration and extension policies.

Other conditions may also apply. These could include stipulations about changes to your loan application or purchase agreement. Any changes could potentially void your rate lock and necessitate a new lock at prevailing rates. Therefore, thoroughly understand all conditions before you commit to a rate lock.

What Can Void a Locked Rate Agreement

A rate lock agreement, while offering security, isn’t impervious to cancellation. Several factors can invalidate your locked-in interest rate, potentially leading to higher borrowing costs. Understanding these possibilities is crucial before committing to a lock.

One common cause is exceeding the lock expiration date. Rate locks are valid only for a specified period, typically ranging from 30 to 60 days. Failing to close the loan within this timeframe usually results in the lock expiring, and you’ll need to renegotiate the interest rate at the prevailing market rates, which may be significantly higher.

Changes to the loan application can also jeopardize your locked rate. This includes any significant alterations to the loan amount, loan term, or property details. For instance, requesting a larger loan amount or adding a co-borrower after the rate lock may trigger a re-evaluation of your eligibility and a potential change in the interest rate.

Failure to meet loan conditions presents another risk. Lenders carefully assess your financial situation during the application process. If your credit score deteriorates significantly, your income drops considerably, or you experience other financial setbacks impacting your ability to repay the loan, the lender may decide to void the rate lock.

Changes in the borrower’s circumstances can also impact the rate lock. A major shift in employment, such as job loss or a significant change in income, might lead the lender to reassess your eligibility and potentially invalidate the lock. Similarly, the discovery of previously undisclosed financial issues can also lead to the agreement being voided.

Finally, some less common scenarios, like appraisal issues or problems with the title of the property, can result in the lender voiding the rate lock agreement. These issues delay the closing process and may cause the lender to deem the existing rate lock invalid.

It’s important to note that the specifics of what can void a rate lock agreement vary between lenders. Carefully review the terms and conditions of your rate lock agreement with your lender to fully understand the circumstances that could invalidate the agreed-upon interest rate. Communication with your lender is key throughout the process.