Facing financial hardship and struggling to manage your student loan payments? You’re not alone. Millions of Americans grapple with the burden of student loan debt, and finding legitimate ways to pause student loan payments can feel overwhelming. This comprehensive guide explores the legal avenues available to help you navigate this challenging situation and provides clear steps to suspend student loan payments while remaining compliant with federal regulations. We’ll cover various options, including deferment, forbearance, and income-driven repayment plans, helping you understand which path best suits your individual circumstances. Discover how to legally pause your student loans and regain control of your finances.

Understanding your rights and the available options for student loan payment relief is crucial. This article will clarify the differences between deferment and forbearance, outlining the eligibility requirements and the potential impact on your credit score. We’ll also explain the process of applying for income-driven repayment plans and explore how these plans can significantly reduce your monthly payments. Learn how to effectively pause student loan payments legally, avoid penalties, and create a sustainable long-term repayment strategy. Take control of your student loan debt today.

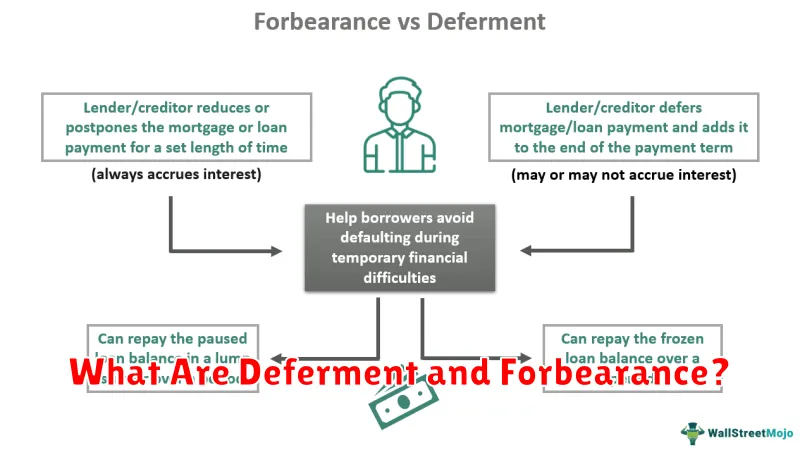

What Are Deferment and Forbearance?

When facing financial hardship, you might consider pausing your student loan payments. Deferment and forbearance are two programs that allow you to temporarily suspend or reduce your monthly payments. While both offer a reprieve from payments, they differ significantly in their eligibility requirements and the impact on your loan.

Deferment is a temporary postponement of your student loan payments, granted under specific circumstances. These circumstances usually involve economic hardship or enrollment in school. Importantly, the interest on certain types of federal student loans may either be subsidized (meaning the government pays it) or unsubsidized (meaning it accrues and is added to your loan balance). Check your loan terms carefully to understand what happens to interest during deferment.

Forbearance, unlike deferment, is typically granted at the lender’s discretion and often requires you to demonstrate financial difficulty. It allows you to temporarily reduce or completely suspend your payments for a specific period. However, unlike some deferment options, interest usually continues to accrue on the loan balance during a forbearance period, leading to a larger total debt once payments resume.

It’s crucial to understand the implications of each before applying. Deferment can be beneficial, especially if your loans are subsidized and you qualify for it based on specific criteria. Forbearance, while providing immediate relief, can lead to a significant increase in your total loan amount due to accumulating interest. It’s recommended to explore all options and carefully weigh the pros and cons before making a decision.

When You Qualify for a Pause

Several programs allow for a temporary pause on your student loan payments, but eligibility requirements vary depending on the specific program. Understanding these requirements is crucial to determine if you qualify for a pause.

One common program is forbearance. This allows for a temporary suspension of payments, often due to financial hardship. However, interest may still accrue during a forbearance period, potentially increasing your overall loan balance. To qualify, you typically need to demonstrate a significant financial challenge, such as unemployment or a medical emergency, through documentation provided to your loan servicer.

Another option is deferment. Similar to forbearance, deferment temporarily suspends payments. However, deferment is usually granted based on specific circumstances such as returning to school, entering military service, or experiencing certain types of economic hardship. The terms and conditions, including the possibility of interest accrual, will depend on the type of loan and the specific deferment program.

Income-driven repayment (IDR) plans offer a different approach to managing student loan payments. While not strictly a pause, these plans adjust your monthly payments based on your income and family size. If your income falls below a certain threshold, your monthly payment may be reduced to $0, effectively pausing payments until your income increases. However, you must recertify your income periodically to maintain eligibility.

It is important to note that the specific requirements for each program can be complex and subject to change. Therefore, it is strongly recommended that you contact your loan servicer directly to discuss your individual circumstances and determine which programs, if any, you qualify for. They can provide you with the most up-to-date and accurate information regarding your eligibility.

How to Apply and What Documents Are Needed

The application process for pausing your student loan payments legally depends on the specific program you qualify for. Understanding which program is right for you is the crucial first step. Generally, applications are submitted online through the relevant government website or the servicer of your student loans. You’ll need to create an account or log in to an existing one.

The required documentation can vary, but some common documents include: proof of income, such as tax returns or pay stubs; proof of enrollment in an eligible program (if applicable); and identification such as a driver’s license or passport. Some programs may also require documentation related to specific hardship circumstances, such as medical bills or proof of unemployment. Carefully review the specific requirements for your chosen program to ensure a smooth application process.

It’s important to note that providing false or misleading information on your application is illegal and can have serious consequences. Complete all fields accurately and thoroughly, and retain copies of all submitted documentation. After submitting your application, you should receive confirmation; monitor your account for updates on the status of your request.

If you are unsure about what documents are needed or the application process itself, contact your loan servicer directly. They can provide specific guidance on the necessary documents for your situation and walk you through the steps to complete the application.

What Happens to Interest During the Pause

The impact of pausing student loan payments on accrued interest depends heavily on the specific type of loan and the terms of any applicable payment pause program. Understanding these nuances is critical to avoid unexpected debt increases after the pause period ends.

For some federal student loans, particularly those under certain forbearance or deferment programs, interest may still accrue during the pause. This means that while you aren’t making payments, the principal balance of your loan is increasing due to accumulating interest. This is a crucial point to remember; the pause does not eliminate the interest. It simply delays the payment.

Other federal loan programs, especially those enacted through government initiatives designed to provide temporary relief, might offer a temporary suspension of interest accrual. However, it is vital to confirm the specifics of your loan program to ensure you understand whether interest will be capitalized (added to the principal balance) upon the resumption of payments. This capitalization of interest can significantly increase the total amount owed.

It’s strongly recommended that borrowers consult their loan servicer directly to understand precisely how interest will be handled during their pause. Detailed information about the program’s effects on interest, and any potential future capitalization, should be provided in your loan documents or through your servicer’s communication.

Careful review of your loan terms and communication with your servicer is the best way to avoid any surprises related to interest accrual during and after a student loan payment pause.

Impact on Loan Balance and Term

Pausing your student loan payments, whether through forbearance or deferment, will not reduce your overall loan balance. Instead, interest will continue to accrue during the pause period. This means your total debt will grow larger than it would have if you were making regular payments.

The impact on your loan term is directly related to the accumulated interest during the pause. Since the principal balance remains unchanged but interest continues to accrue, your repayment period will likely be extended. You might end up making payments for a longer duration to repay both the original principal and the accumulated interest. The precise impact will depend on the interest rate and the length of the pause.

It’s crucial to understand that any interest accrued during a forbearance or deferment period will typically be capitalized at the end of the pause. This means it’s added to your principal balance, increasing the total amount you owe and potentially further extending your repayment term. You are essentially paying interest on interest, increasing the overall cost of your loan.

Therefore, while pausing payments offers temporary relief, it’s essential to weigh the short-term benefits against the long-term consequences of increased interest and an extended repayment period. Careful consideration of the potential financial implications is crucial before opting for a payment pause.

Alternatives If You Don’t Qualify for Pause

If you’re unable to qualify for a student loan payment pause program, several alternatives exist to manage your debt and avoid delinquency. Exploring these options is crucial to maintain a positive credit history and avoid the negative consequences of missed payments.

One viable option is to explore income-driven repayment (IDR) plans. These plans adjust your monthly payments based on your income and family size. Several IDR plans are available, each with its own eligibility requirements and repayment terms. Carefully compare them to find the most suitable fit for your financial circumstances. Contact your loan servicer to discuss enrollment possibilities and understand the implications of each plan.

Another strategy involves consolidating your loans. Consolidation combines multiple student loans into a single loan with a potentially lower monthly payment and a simplified repayment process. However, it’s essential to understand the long-term implications, such as potential increases in the total interest paid over the life of the loan. Weigh the benefits and drawbacks before making this decision.

Deferment or forbearance may be available, depending on your specific circumstances. These options temporarily postpone your payments, though interest may still accrue on most loans during this period. Deferment is usually granted due to specific qualifying events such as unemployment or graduate school enrollment. Forbearance is often granted on a case-by-case basis by the loan servicer. Eligibility criteria for both deferment and forbearance vary depending on your loan type and lender, so directly contacting your loan servicer is recommended.

Finally, consider seeking professional financial advice. A financial advisor can help you analyze your overall financial situation, assess your available options, and create a personalized repayment plan tailored to your specific needs and capabilities. They can provide valuable insights and guidance in navigating the complexities of student loan repayment.