Facing the prospect of a personal loan can be daunting, especially when understanding the intricacies of prepayment penalties. This comprehensive guide will equip you with the knowledge necessary to navigate this often-complex area of personal finance. We will explore what prepayment penalties are, how they’re calculated, and importantly, how to avoid them. Understanding these penalties is crucial to making informed decisions about your personal loan and avoiding unexpected costs. Learning about prepayment penalties empowers you to choose the best loan option and manage your finances effectively.

Many borrowers are unaware of prepayment penalties on personal loans until they’re faced with the situation of repaying their loan early. This can lead to significant financial burdens and unexpected expenses. This article will dissect the various types of prepayment penalties, including interest rate penalties and flat fees, providing clear examples and explanations to ensure a thorough understanding. We’ll also explore strategies for finding personal loans without prepayment penalties, thereby saving you valuable money and avoiding potential financial pitfalls. By the end, you’ll be confident in your ability to negotiate and understand the terms of your next personal loan.

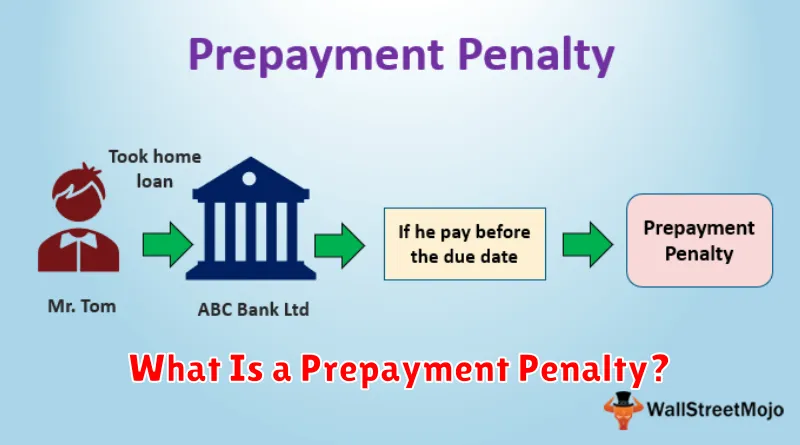

What Is a Prepayment Penalty?

A prepayment penalty is a fee charged by a lender when a borrower pays off a loan earlier than the agreed-upon repayment schedule. This penalty essentially compensates the lender for lost interest income they would have otherwise received had the loan remained outstanding for its full term.

The amount of the prepayment penalty can vary greatly depending on several factors, including the type of loan, the lender’s policies, and the length of time remaining on the loan. Some lenders may charge a fixed dollar amount, while others might assess a percentage of the remaining loan balance. Understanding the specific terms of your loan agreement is crucial to determining if a prepayment penalty applies and, if so, how much it will cost.

It’s important to note that not all personal loans include prepayment penalties. Many lenders, especially those offering competitive rates, avoid imposing such fees to attract borrowers. However, borrowers should always carefully review the loan documents before signing to ascertain whether a prepayment penalty clause is present and, if so, the exact conditions under which it would be applied.

The presence of a prepayment penalty can significantly impact a borrower’s decision to refinance or pay off a loan early. If the penalty exceeds the potential savings from refinancing or a lower interest rate, it might be more financially advantageous to continue with the original loan terms. Careful financial planning is essential before deciding to prepay a loan with a penalty clause.

Why Lenders Charge for Early Repayment

Lenders charge for early repayment, often referred to as a prepayment penalty, primarily because it impacts their projected revenue. When a borrower repays a loan early, the lender loses out on the interest income they had anticipated earning over the loan’s full term.

The interest rate offered on a personal loan is calculated based on the entire loan term. By shortening this term through early repayment, the lender receives less interest than initially projected, affecting their profitability. This loss is often mitigated by charging a prepayment penalty.

Another factor is the opportunity cost for the lender. The funds repaid early could have been reinvested in other, potentially higher-yielding, opportunities. The prepayment penalty helps compensate for the lost potential earnings from these alternative investments.

Furthermore, lenders consider the administrative costs associated with processing early loan repayments. While these costs are typically not substantial, they can add to the overall impact of early repayment on the lender’s bottom line. The penalty may also serve as a deterrent for borrowers who might be tempted to take advantage of favorable interest rates for a short duration.

It’s important to note that not all lenders charge prepayment penalties. Understanding the terms and conditions of your loan agreement, particularly regarding prepayment, is crucial before securing a personal loan.

How to Check If Your Loan Includes This Fee

Determining whether your personal loan includes a prepayment penalty is crucial for financial planning. Understanding this fee can significantly impact your ability to manage your debt effectively.

The most reliable way to confirm the existence of a prepayment penalty is to carefully review your loan agreement. This document, provided by your lender at the time of loan origination, outlines all the terms and conditions of your loan, including any applicable fees.

Look for specific clauses mentioning prepayment penalties, early repayment fees, or similar terminology. The agreement should clearly state the amount of the penalty, either as a fixed dollar amount or a percentage of the outstanding loan balance. It may also specify the conditions under which the penalty applies, such as paying off the loan before a certain date or within a defined timeframe.

If you’re unable to locate this information within the loan agreement, don’t hesitate to contact your lender directly. Their customer service department should be able to provide clarification on this important detail. Be prepared to provide your loan number or other identifying information to expedite the process.

It is also advisable to request a copy of the loan amortization schedule. This schedule details your monthly payments and the loan balance over time. While it may not explicitly mention prepayment penalties, it can be helpful in understanding the potential financial implications of early repayment.

By thoroughly reviewing your loan documents and communicating with your lender, you can accurately determine whether your loan agreement includes a prepayment penalty and plan your repayment strategy accordingly.

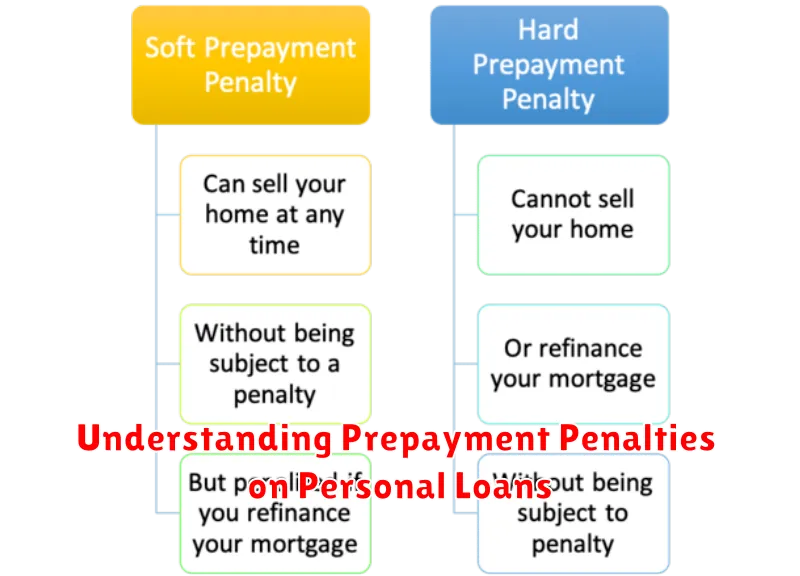

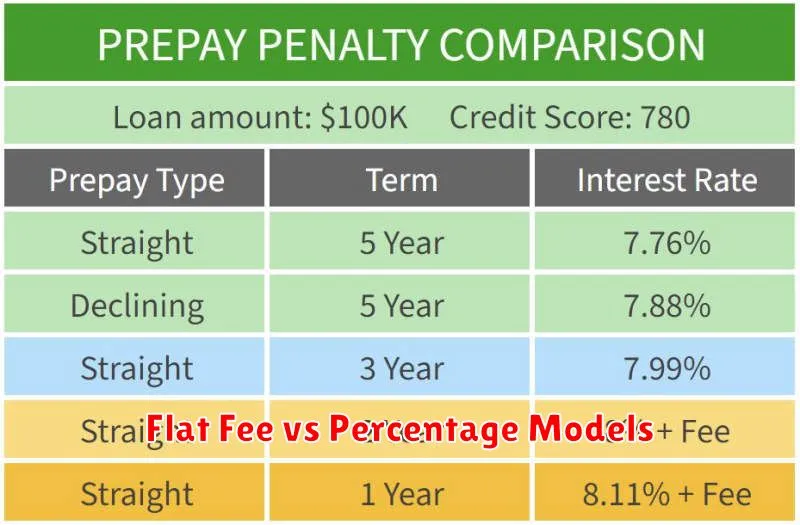

Flat Fee vs Percentage Models

When it comes to prepayment penalties on personal loans, lenders typically employ one of two primary models: a flat fee or a percentage of the outstanding loan balance. Understanding the nuances of each is crucial for borrowers.

A flat fee model charges a fixed amount, regardless of how much of the loan principal you repay early. For instance, a penalty might be a predetermined sum like $200. This approach offers predictability; the borrower knows exactly how much they will be charged if they choose to prepay. However, it can be disproportionately costly for smaller loans, representing a larger percentage of the outstanding balance.

In contrast, a percentage-based penalty is calculated as a certain percentage of the prepayment amount. A common example would be a penalty of 2% of the prepaid principal. This model appears fairer for larger loans since the penalty increases proportionally with the loan size. Conversely, the actual cost remains uncertain until the borrower decides on a specific prepayment amount.

The choice between a flat fee and a percentage model significantly impacts the cost-effectiveness of prepaying a personal loan. Borrowers should carefully review the terms and conditions of their loan agreement to ascertain the specific prepayment penalty structure and evaluate its implications before making any early repayment decisions.

When It Makes Sense to Pay the Penalty

While prepayment penalties are generally undesirable, there are rare circumstances where paying the penalty might be a financially sound decision. This typically hinges on a comparison between the cost of the penalty and the potential savings or benefits gained by paying off the loan early.

One such scenario involves a significant decrease in interest rates. If you can secure a new loan with substantially lower interest rates, the savings from reduced interest payments over the remaining loan term might outweigh the prepayment penalty. Careful calculations are crucial to determine if this is indeed the case.

Another situation might involve an unexpected financial windfall, such as an inheritance or bonus. If you have extra funds available and the penalty is relatively small compared to the amount of debt being repaid, it could be advantageous to eliminate the loan entirely and free up cash flow. This depends on the individual’s financial goals and priorities.

Furthermore, the specific terms of the penalty clause play a critical role. Some loans have penalties that decrease over time, making prepayment more appealing towards the end of the loan term. It’s also essential to understand how the penalty is calculated; a percentage of the remaining balance versus a flat fee drastically alters the equation.

Ultimately, the decision to pay a prepayment penalty requires a thorough cost-benefit analysis. Consider consulting with a financial advisor to assess your personal financial situation and determine the best course of action. They can help you weigh the potential benefits against the penalty and make an informed decision tailored to your circumstances.

How to Avoid Prepayment Charges Legally

Understanding the legalities surrounding prepayment penalties is crucial for borrowers. Many personal loans include clauses allowing lenders to charge a fee if you repay the loan early. However, there are ways to navigate these clauses and potentially avoid these charges.

One key strategy is to carefully review the loan agreement before signing. Look for specific clauses detailing prepayment penalties, including the calculation method and any potential waivers. Understanding the terms and conditions thoroughly will equip you to negotiate or identify loopholes.

Negotiation with the lender is another viable option. Many lenders are willing to waive or reduce prepayment penalties, especially if you have a strong reason for early repayment, such as an unexpected inheritance or a better loan offer. A well-reasoned request, presented professionally, can significantly increase your chances of success.

Choosing a loan with no prepayment penalties is the most straightforward way to avoid these charges altogether. While these loans might have slightly higher interest rates, the long-term savings from avoiding penalties can often outweigh the minor interest difference, depending on your repayment plan.

Finally, some state laws prohibit or restrict prepayment penalties on certain types of loans. Familiarize yourself with your state’s regulations regarding consumer lending. This knowledge can provide additional leverage during negotiations or serve as grounds for disputing a penalty.