Considering refinancing your student loans? It’s a significant financial decision that could potentially save you thousands of dollars over the life of your loan, but it’s crucial to understand the implications before you proceed. This article will explore what happens when you refinance student loans, examining the process, the potential benefits, and the potential drawbacks to help you make an informed choice. We’ll delve into factors like interest rate reductions, monthly payment adjustments, and the impact on your credit score, empowering you to navigate this complex financial landscape effectively.

Student loan refinancing can streamline your payments by consolidating multiple loans into a single, more manageable payment. However, it’s essential to weigh the pros and cons carefully. This guide will clarify the eligibility requirements, the different types of refinancing options available, and the long-term financial consequences. Whether you’re seeking a lower interest rate, a shorter loan term, or simply a simplified payment structure, understanding the process of student loan refinancing is paramount to making the best decision for your financial future. We will provide you with the necessary information to determine if refinancing your student loans is the right path for you.

What Student Loan Refinancing Really Means

Student loan refinancing is the process of replacing your existing student loans with a new loan from a private lender. This new loan typically comes with a different interest rate and loan terms than your original loans.

The primary goal of refinancing is often to secure a lower interest rate. A lower interest rate can significantly reduce the total amount you pay over the life of the loan, saving you money in the long run. However, it’s crucial to understand that refinancing also involves a new loan agreement with new terms and conditions.

Key considerations when refinancing include the new interest rate offered, the length of the repayment term (which affects your monthly payments), and any associated fees. It’s essential to compare offers from multiple lenders to find the most advantageous deal. Be aware that refinancing may affect your eligibility for certain government loan forgiveness programs.

Refinancing can consolidate multiple student loans into a single, more manageable monthly payment. This simplification can improve financial organization and make budgeting easier. However, consolidating loans might lengthen the repayment period, potentially increasing the total interest paid, despite a lower interest rate.

It’s vital to carefully review the terms and conditions of any refinancing offer before proceeding. Consider the long-term financial implications and ensure the new loan aligns with your financial goals and circumstances. Seeking professional financial advice can be beneficial before making a decision.

Federal vs Private Refinancing Options

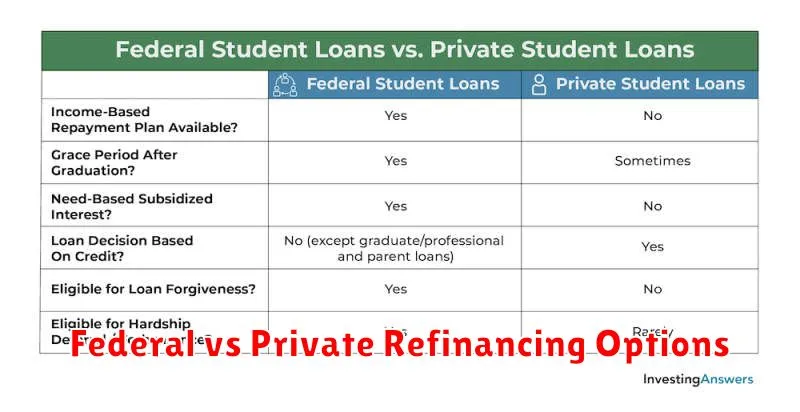

When considering student loan refinancing, you’ll encounter two primary options: federal and private refinancing. Understanding the key differences between these options is crucial for making an informed decision.

Federal refinancing, offered through the federal government, consolidates multiple federal student loans into a single new loan with a potentially lower interest rate. A significant advantage is the potential for income-driven repayment plans and federal protections, such as forbearance and deferment, in case of financial hardship. However, federal refinancing is currently limited in its availability, and you may not qualify if your loans aren’t already federal.

Private refinancing, on the other hand, involves obtaining a new loan from a private lender to replace your existing federal or private student loans. Private lenders often offer more competitive interest rates, especially for borrowers with excellent credit scores. They may also provide options for shorter loan terms, leading to faster repayment. However, private refinancing means losing access to federal protections and benefits, such as income-driven repayment plans, and you may face stricter eligibility requirements and penalties for missing payments.

The best option depends heavily on your individual financial situation, credit score, and loan type. Carefully weigh the potential benefits and drawbacks of each before making a decision. Consider consulting with a financial advisor to help you determine which option aligns best with your long-term financial goals.

How It Can Change Your Interest Rate

Refinancing your student loans can significantly impact your interest rate. Your current interest rate is likely fixed at the rate you were offered when you initially took out the loan. However, refinancing allows you to potentially secure a lower interest rate, depending on your creditworthiness and the current market conditions.

A lower interest rate translates directly into lower monthly payments and a reduction in the total amount of interest paid over the life of the loan. This is because you’ll be paying less each month towards interest, allowing more of your payment to go towards the principal balance. This ultimately saves you money and helps you pay off your debt faster.

Conversely, it’s possible that you might receive a higher interest rate after refinancing. This could occur if your credit score has declined since you initially took out your loans, or if interest rates have risen in the market. Therefore, it’s crucial to shop around and compare offers from multiple lenders before making a decision to ensure you’re getting the best possible rate.

The type of loan you refinance also plays a role. Federal student loans often come with benefits like income-driven repayment plans and potential loan forgiveness programs. Refinancing into a private loan can mean losing access to these benefits. Carefully weigh the potential savings from a lower interest rate against the potential loss of these federal protections.

Ultimately, the impact on your interest rate is highly individualized and depends on several factors. A thorough understanding of your current financial situation and a comparison of available refinancing options are necessary to determine whether refinancing will lead to a lower interest rate and overall cost savings.

Will You Lose Forgiveness or Protection?

Refinancing your student loans can have significant implications for any existing forgiveness or income-driven repayment (IDR) plans you may be enrolled in. These programs offer crucial protections, such as loan forgiveness after a certain number of years or reduced monthly payments based on your income. Refinancing typically involves taking out a new loan to pay off your existing student loans, often with a private lender. This action will almost certainly remove your loans from the federal student loan system.

Because private loans don’t participate in federal forgiveness or IDR programs, refinancing effectively removes you from the eligibility for these benefits. This means you could lose out on potential loan forgiveness, resulting in a substantially higher total repayment amount. Similarly, if you rely on an IDR plan to manage your monthly payments, refinancing will terminate your eligibility for that plan as well, potentially leading to significantly higher monthly payments.

Before considering refinancing, carefully weigh the potential benefits of a lower interest rate against the significant risk of losing valuable federal protections. Thoroughly evaluate your financial situation and consider the long-term implications. It’s crucial to understand that the decision to refinance is irreversible, and you cannot easily reinstate your eligibility for federal loan forgiveness or IDR plans once you’ve refinanced your loans with a private lender.

Consider seeking professional financial advice to help you assess your individual circumstances and determine whether refinancing is the right choice for you. They can help you understand the potential consequences of losing these federal benefits and can help determine if the potential for lower interest rates outweighs the loss of these valuable protections.

How to Compare Lenders for Refinance

Refinancing your student loans can offer significant savings, but choosing the right lender is crucial. To ensure you secure the best possible terms, a thorough comparison of lenders is essential. This involves considering several key factors.

First, focus on the interest rate. This is the cost of borrowing money, expressed as a percentage. A lower interest rate translates directly into lower monthly payments and less overall interest paid over the life of the loan. Compare rates from multiple lenders, paying close attention to whether they are fixed or variable. Fixed rates remain constant throughout the loan term, providing predictability, while variable rates can fluctuate, potentially leading to higher payments.

Next, examine the loan terms. This includes the repayment period (the length of time you have to repay the loan), which impacts your monthly payment amount. Shorter terms mean higher monthly payments but less interest paid overall, while longer terms result in lower monthly payments but more total interest paid. Carefully consider your budget and financial goals when choosing a repayment period. Also review any fees associated with the loan, such as origination fees or prepayment penalties. These can significantly impact the overall cost.

Beyond rates and terms, consider the lender’s reputation and customer service. Look for lenders with a proven track record of fair practices and responsive customer support. Reading online reviews can provide valuable insights into other borrowers’ experiences. Additionally, check the lender’s eligibility requirements to ensure you meet their criteria before applying. This can save you time and effort in the long run.

Finally, understand the loan’s features. Some lenders might offer additional benefits such as hardship programs or flexible repayment options. Carefully consider these aspects to determine which lender best fits your individual needs and circumstances. By comparing these essential aspects across multiple lenders, you can make an informed decision and secure the most advantageous student loan refinance.

Common Mistakes to Avoid When Refinancing

Refinancing student loans can be a complex process, and making mistakes can have significant financial consequences. Avoiding these common pitfalls will help ensure a smooth and beneficial refinancing experience.

One major mistake is failing to shop around. Different lenders offer varying interest rates and terms. Comparing offers from multiple lenders is crucial to securing the best possible deal. Don’t settle for the first offer you receive.

Another frequent error is ignoring fees. While a lower interest rate may seem appealing, be sure to carefully review all associated fees, including origination fees, prepayment penalties, and application fees. These costs can significantly impact the overall savings from refinancing.

Not understanding your credit score is also a common mistake. Your credit score plays a vital role in determining the interest rate you qualify for. Reviewing your credit report and addressing any inaccuracies beforehand can improve your chances of obtaining a more favorable rate.

Overlooking the impact on your tax benefits is a critical oversight. Depending on your loan type and the terms of your refinancing agreement, you might lose certain tax benefits associated with federal student loans. Thoroughly investigate the tax implications before proceeding.

Finally, many people make the mistake of refinancing without a clear financial plan. Before refinancing, carefully consider your current financial situation, including your income, expenses, and debt levels. Ensure that the new loan terms align with your long-term financial goals.