Understanding title insurance is crucial when navigating the complexities of a mortgage. This often-overlooked aspect of the home-buying process provides critical protection against unforeseen title defects that could jeopardize your ownership and financial investment. A title insurance policy acts as a safety net, safeguarding you from potential legal challenges and financial losses related to issues with the property’s ownership history, such as liens, encumbrances, or inaccurate property descriptions. Ignoring this vital component could lead to costly and time-consuming legal battles down the line.

This article will delve into the intricacies of title insurance for mortgages, explaining the different types of policies available—owner’s title insurance and lender’s title insurance—and highlighting their respective benefits. We’ll clarify the process involved in obtaining title insurance, address common concerns and misconceptions surrounding it, and ultimately empower you to make informed decisions during your home purchase. Learning about title insurance is an essential step in ensuring a smooth and secure mortgage transaction.

What Is Title Insurance and Why It Exists

Title insurance is a crucial component of the mortgage process, offering protection against unforeseen problems with the ownership of a property. It’s an insurance policy that safeguards both the lender (mortgage company) and the buyer (borrower) against financial losses resulting from title defects.

A title defect is any issue that clouds the clear ownership of a property. These issues can range from minor errors in property records to significant claims against the property, including liens, unpaid taxes, easements not properly documented, or even outstanding claims from previous owners. Discovering such defects after purchasing a home can be incredibly costly and stressful.

Title insurance exists primarily to mitigate these risks. Before issuing a mortgage, lenders require title insurance to protect their investment. They need assurance that the borrower has a clear and marketable title to the property, ensuring they can reclaim the property if the borrower defaults on the loan. Additionally, it protects the buyer from financial losses arising from undiscovered title problems before or after the purchase.

Without title insurance, both lenders and buyers would face significant financial vulnerability. The cost of resolving title issues can easily exceed the value of a home’s equity or the amount of a mortgage, potentially leading to severe financial hardship. Therefore, title insurance acts as a safety net, providing peace of mind and financial security to all parties involved in a real estate transaction.

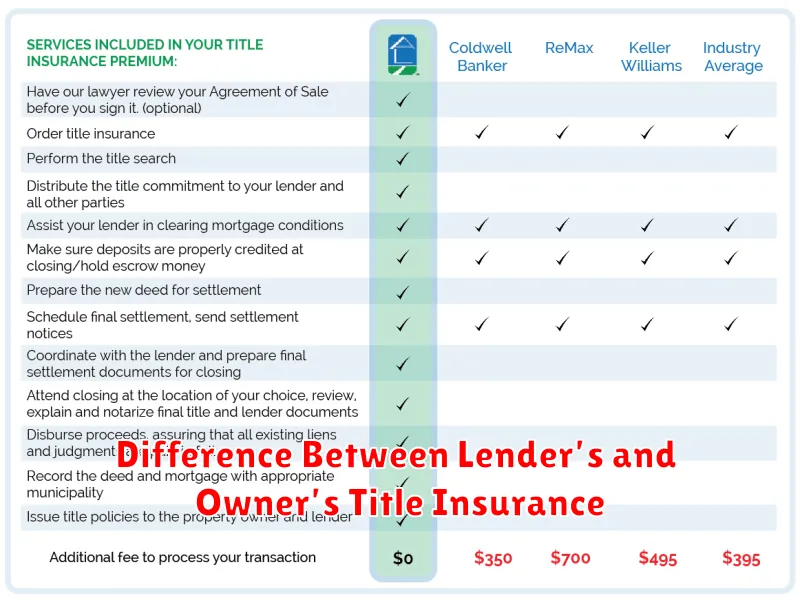

Difference Between Lender’s and Owner’s Title Insurance

When securing a mortgage, you’ll likely encounter two types of title insurance: lender’s title insurance and owner’s title insurance. While both protect against title defects, they cover different parties and offer distinct levels of protection.

Lender’s title insurance protects the lender (the bank or mortgage company) against financial loss if problems arise with the property’s title after the loan is made. It ensures the lender’s interest in the property is valid and free from defects that could affect their ability to recover the loan amount should you default. This policy typically covers issues like undisclosed liens, forged documents, or inaccurate property descriptions. The policy amount is equivalent to the loan amount and decreases as the loan balance is paid down.

Owner’s title insurance, on the other hand, protects the homeowner. It safeguards the owner’s equity in the property against losses caused by title defects. This means if a title problem surfaces that affects your ownership, the policy will help cover legal costs and financial losses associated with resolving the issue. Unlike lender’s title insurance, owner’s title insurance is a one-time premium that provides coverage for as long as you or your heirs own the property.

A key distinction lies in the beneficiaries. Lender’s title insurance benefits the lender, while owner’s title insurance protects the homeowner. While your lender will typically require you to purchase lender’s title insurance, you are strongly encouraged to purchase owner’s title insurance as well, to protect your own investment.

In essence, obtaining both types of title insurance provides comprehensive protection for both the lender and the homeowner, offering peace of mind throughout the mortgage process and beyond.

What Risks Title Insurance Covers

Title insurance is a crucial part of the mortgage process, protecting both the lender and the homeowner from financial losses stemming from title defects. These defects are essentially problems with the ownership of the property that could jeopardize your claim to it.

Lender’s title insurance protects the lender’s financial interest in the property. It safeguards against losses if, for example, a prior lien or claim on the property surfaces that was not disclosed during the title search. This could include undiscovered mortgages, tax liens, or judgments against previous owners.

Owner’s title insurance, on the other hand, protects the homeowner’s investment. This policy insures against a wider range of title defects that could affect the homeowner’s ownership rights. These risks include, but are not limited to: forgery in the chain of title, errors in public records, unrecorded easements, and boundary disputes. It also covers situations where someone else has a rightful claim to the property, even if that claim wasn’t discoverable at the time of purchase.

It’s important to note that title insurance does not cover every possible problem. Problems arising after the policy is issued, such as damage to the property or disputes with neighbors unrelated to ownership, are generally not covered. Furthermore, the policy typically won’t cover issues that were known to the buyer at the time of purchase. A thorough title search and examination is therefore crucial to identify potential issues before purchasing the property and securing the insurance.

One-Time Fee and Typical Cost Range

Title insurance is a one-time fee paid at closing, unlike other ongoing mortgage costs. This fee protects both the lender and the buyer from future financial losses due to title defects or liens.

The actual cost varies depending on several factors, including the property’s value, location, and the complexity of the title search. A title search is the process of examining public records to verify ownership and identify any potential problems with the title.

Generally, the cost of title insurance is a percentage of the purchase price. For example, lender’s title insurance, which protects the lender’s investment, tends to be less expensive than owner’s title insurance, covering the buyer’s interest. Expect to pay a few hundred to several thousand dollars for both policies, depending on the factors mentioned above.

Lender’s title insurance typically ranges from 0.5% to 1% of the loan amount, while owner’s title insurance is often a one-time fee comparable to or slightly less than the lender’s policy. It is crucial to get detailed quotes from multiple title insurance companies to compare costs and coverage.

In addition to the premiums, expect to incur other related closing costs such as recording fees, escrow fees, and other administrative expenses. These charges are usually separate from the title insurance premium and should be considered when budgeting for the overall cost of closing a mortgage.

How to Read a Title Report Before Closing

A title report is a crucial document you’ll receive before closing on a home purchase. It details the ownership history of the property and identifies any potential claims or liens that could affect your ownership. Understanding this report is vital to ensure a smooth and problem-free closing.

Begin by examining the property description section. Verify that the address and legal description match the property you’re buying. Any discrepancy here requires immediate clarification with your title company.

Next, carefully review the chain of title. This section traces the ownership history, showing previous owners and any transfers of ownership. Look for any unusual transactions or gaps in ownership. Unusual transactions might indicate potential problems.

The exceptions section lists any potential issues that could affect your ownership. These exceptions may include liens (like unpaid taxes or mortgages), easements (rights of way granted to others), or encroachments (structures that extend onto neighboring property). Understanding the nature and severity of these exceptions is critical. Your real estate attorney or title company representative can assist in interpreting these exceptions.

Pay close attention to any encumbrances listed. These are claims or rights against the property that could limit your use or ownership. Common encumbrances include mortgages, easements, and unpaid property taxes. The title report will typically state whether these encumbrances will be removed at closing.

Finally, review the survey information, if included. This information describes the property’s boundaries and can help identify any potential boundary disputes. Discrepancies here may require a new survey.

Don’t hesitate to ask questions. If anything in the title report is unclear or raises concerns, contact your title company or real estate attorney for clarification. A thorough understanding of the title report is a crucial step in protecting your investment.

When Title Insurance Claims Are Made

Title insurance claims are made when a covered title defect is discovered after the closing of a real estate transaction. This means that a problem with the ownership or other issues with the property’s title are found that were not revealed during the title search process.

These defects can manifest in various ways. A common example involves uncovering prior liens or encumbrances on the property that were not previously known or properly addressed. This could include unpaid taxes, mortgages, judgments, or easements that affect the ownership rights of the new property owner.

Another scenario leading to a claim involves discovering forgeries or other issues with the chain of title. If there are irregularities in the documentation tracing the property’s ownership history, this could result in a valid claim. Similarly, disputes regarding boundary lines or ownership rights could necessitate the use of title insurance.

It’s important to understand that not all title issues result in successful claims. The specific terms and conditions outlined in the title insurance policy dictate what is covered. Exclusions and exceptions exist, and a claim will only be successful if the defect falls under the policy’s coverage.

The process of filing a claim typically involves contacting the title insurance company and providing documentation supporting the existence of the title defect. The insurer will then investigate the claim and determine its validity based on the terms of the policy. Quick action on the part of the insured is generally crucial to initiate the claim and ensure a smoother process.

While title insurance is designed to protect against unforeseen title problems, it’s a crucial element of ensuring a smooth and secure real estate transaction. The timely filing of a claim when a covered title defect is discovered is essential to safeguarding the property owner’s interests.